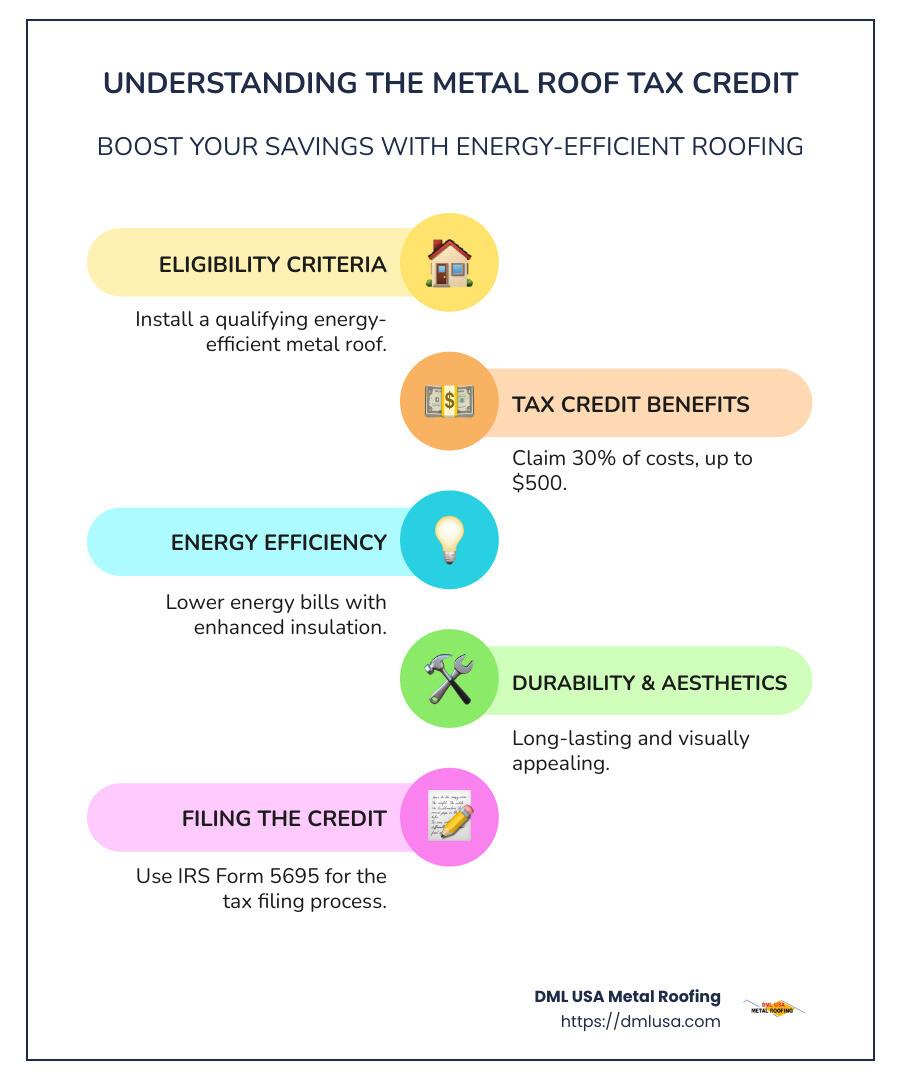

The metal roof tax credit offers homeowners a fantastic opportunity to save money while investing in an energy-efficient roofing solution. In a nutshell, installing a qualified energy-efficient metal roof can not only improve the durability and aesthetic appeal of your home but also provides potential savings through tax incentives.

- Eligibility Criteria:

- Must install an energy-efficient metal roof with specific reflectance standards.

- The tax credit allows you to claim 30% of the installation costs (up to $500).

- Benefits of an Energy-Efficient Metal Roof:

- Reduces energy bills by keeping your home cooler in summer and warmer in winter.

- Provides improved durability and lower maintenance requirements.

Investing in a metal roof not only leads to a more comfortable living environment but can also extend the lifespan of your roof and contribute to environmental sustainability. Understanding these benefits can significantly impact your decision-making process regarding roofing upgrades.

I’m Adam Kadziola, an expert in metal roofing. At DML USA Metal Roofing, we specialize in manufacturing high-quality, durable metal roofing products. With over a decade of experience, I’ve seen the benefits these roofs can offer, including potential tax incentives like the metal roof tax credit, energy savings, and increased home value.

Understanding the Metal Roof Tax Credit

The metal roof tax credit is a government incentive designed to encourage homeowners to invest in energy-efficient roofing solutions. This credit can help you save money while enhancing the sustainability and comfort of your home.

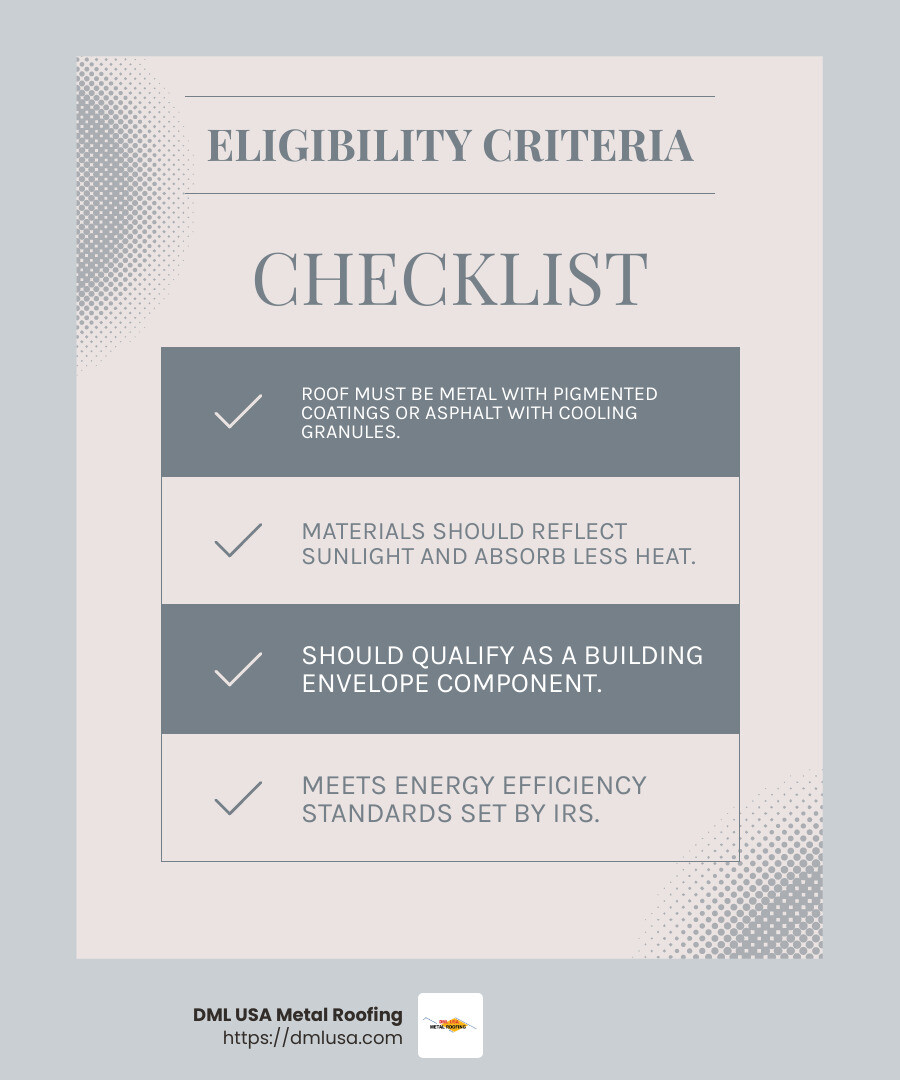

Eligibility Criteria

To qualify for the metal roof tax credit, your new roof must meet specific energy efficiency standards. Here’s what you need to know:

- Qualifying Roofs: The roof must be a metal roof with appropriate pigmented coatings or an asphalt roof with cooling granules. These materials are specifically designed to reduce heat gain in your home.

- Energy Standards: The roofing material should meet the energy efficiency standards set by the IRS. This includes being designed to reflect more sunlight and absorb less heat than a standard roof.

While the IRS has removed specific mentions of roofs from the 2023 tax code, it’s possible that a roof might still qualify as a “building envelope component” if it primarily reduces heat loss or gain.

How to Claim the Credit

To claim the metal roof tax credit, you’ll need to follow the IRS guidelines and complete the necessary tax forms. Here’s a simple breakdown of the process:

- Form 5695: This is the form you’ll need to file with your tax return to claim the credit. Make sure to fill out Part II of the form, which is dedicated to Residential Energy Credits.

- Tax Filing Process: File the form with your annual tax return. Ensure you have all receipts and documentation that prove your roof meets the eligibility criteria. This includes installation costs and any certifications from the roofing manufacturer.

The credit applies to the year the roof was installed, not purchased. So, if you installed your roof in 2024, you would claim the credit on your 2024 tax return.

By understanding these guidelines and ensuring your roof meets the necessary standards, you can take full advantage of the metal roof tax credit. This not only helps reduce your tax liability but also promotes energy efficiency in your home.

Benefits of Metal Roofs

When considering a new roof, metal offers numerous advantages that go beyond just aesthetics. Let’s explore why a metal roof might be the best choice for your home.

Energy Efficiency

Metal roofs are champions of energy efficiency. Thanks to their reflective coatings, they bounce back most of the sun’s rays. This means your home stays cooler in the summer, reducing the need for air conditioning. In fact, installing a reflective metal roof can save you up to 40% in summer cooling costs, according to the Cool Metal Roofing Coalition and the Oak Ridge National Laboratory.

Longevity and Durability

Metal roofs are built to last. They can withstand extreme weather conditions, from high winds to heavy snow. With a wind resistance rating of up to 120 mph, they’re a solid choice for areas prone to storms. Additionally, metal roofs are fire-resistant, giving you peace of mind if you live in wildfire-prone regions.

Their durability doesn’t stop there. Metal roofs have impact resistance, making them less likely to suffer damage from hail. This toughness means fewer repairs and replacements over time, saving you money in the long run.

Aesthetic Appeal

Gone are the days when metal roofs were plain and industrial-looking. Today, they come in a variety of colors and styles, allowing you to improve your home’s curb appeal. Whether you prefer a classic look or something more modern, there’s a metal roofing option that fits your style.

Conclusion

Choosing a metal roof isn’t just about looks or durability. It’s about making a smart investment in your home’s efficiency and safety. With the potential for significant energy savings and a lifespan that outlasts traditional roofing materials, metal roofs offer a compelling case for homeowners looking to maximize their savings and sustainability.

Up next, we’ll explore how you can further maximize your savings with metal roofs, including comparing initial costs and long-term benefits.

Maximizing Your Savings with Metal Roofs

Comparing Costs and Savings

Investing in a metal roof can seem pricey at first. The initial investment is typically higher than traditional roofing materials like asphalt shingles. However, this upfront cost is often offset by long-term savings. Metal roofs are known for their energy efficiency, which can lower your cooling costs by up to 40% in the summer. This means you’ll save money on energy bills year after year.

When considering the return on investment, it’s important to look beyond just the initial price. Metal roofs are maintenance-free and have a lifespan of 50 years or more. This durability means fewer repairs and replacements, which translates into significant savings over time. Plus, some insurance companies offer reduced rates for homes with metal roofs due to their high resistance to hail and fire.

Additional State Incentives

Besides the federal metal roof tax credit, many states offer additional incentives to encourage energy-efficient home improvements. These state-specific credits can further reduce the cost of installing a metal roof. For example, some states provide property tax exemptions for energy-efficient upgrades, which can lower your annual property taxes.

It’s worth checking with your local government or a tax professional to see if any property tax exemptions or state credits apply to your new metal roof. These incentives can make the decision to go with a metal roof even more financially attractive.

By taking advantage of these savings opportunities, you can maximize the financial benefits of your metal roof, making it a smart and sustainable choice for your home.

Frequently Asked Questions about Metal Roof Tax Credit

What is the maximum credit available?

The metal roof tax credit allows homeowners to claim a tax credit of up to 30% of the cost of materials, with a maximum limit of $1,200. This is a significant increase from previous years, thanks to recent changes in the Inflation Reduction Act. This credit only applies to the cost of the roofing materials and not the labor or installation costs.

Are installation costs included?

No, installation costs are not included in the metal roof tax credit. The credit only covers the cost of the materials used for the roof. This means that while you can claim a portion of what you spend on the actual roofing materials, any labor or installation fees won’t count towards the tax credit. Make sure to keep your receipts and documentation to accurately claim the materials cost on your taxes.

Can I claim the credit for rental properties?

The metal roof tax credit is designed for homeowners who make energy-efficient improvements to their principal residence. Unfortunately, this means you cannot claim the credit for rental properties. The credit is specifically aimed at encouraging homeowners to invest in energy-saving upgrades for their primary home. If you’re considering improvements to a rental property, it’s a good idea to consult with a tax professional to explore other potential tax benefits.

Conclusion

Choosing a metal roof from DML USA Metal Roofing is not just a smart investment for your home, but also a way to save on taxes. Our Illinois-based company is committed to providing high-quality, durable, and energy-efficient metal roofing products. These roofs are not only built to withstand the harshest of weather conditions, but they also come with the added benefit of a metal roof tax credit.

By opting for our metal roofing systems, you can take advantage of the energy tax credits available, which can significantly reduce the overall cost of your investment. These credits are designed to encourage homeowners to choose energy-efficient options, and metal roofs are a perfect fit due to their reflective coatings and superior insulation properties.

Our products are engineered to be maintenance-free, offering long-term savings beyond the initial installation. With features like fire resistance, wind resistance, and impact resistance, our metal roofs provide peace of mind and improved protection for your home.

If you’re ready to explore the benefits of metal roofing, we invite you to learn more about our offerings by visiting our DML USA Metal Roofing Products page. Find how you can maximize your savings and enjoy the aesthetic and functional benefits of a metal roof.