Save Money With Metal Roof Tax Credits in 2025

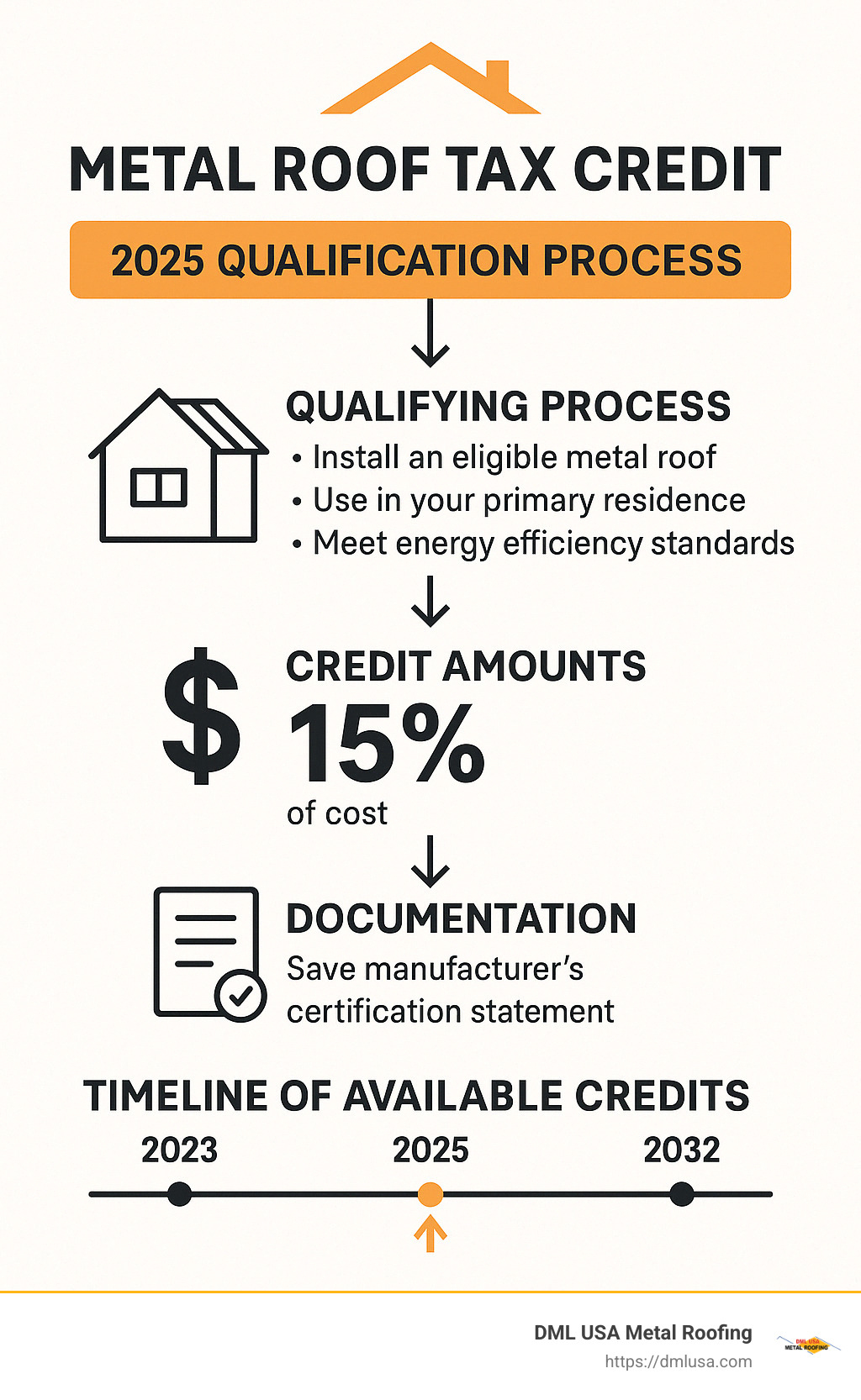

Looking for quick information about the metal roof tax credit 2025? Here’s what you need to know:

| Metal Roof Tax Credit 2025 Key Facts | Details |

|---|---|

| Credit Amount | 30% of material costs (installation costs excluded) |

| Maximum Credit | $1,200 annual limit |

| Qualifying Roofs | Metal roofs with pigmented coatings that meet Energy Star requirements |

| How to Claim | File IRS Form 5695 with your tax return |

| Documentation Needed | Manufacturer’s Certification Statement, receipts, proof of Energy Star compliance |

| Credit Type | Non-refundable (reduces tax liability but won’t generate a refund) |

The metal roof tax credit 2025 continues the energy efficiency incentives established by the Inflation Reduction Act, offering homeowners significant tax savings when installing qualified metal roofing systems. This credit is designed to encourage energy-efficient home improvements that reduce cooling costs and environmental impact.

Metal roofs with special pigmented coatings qualify for this credit because they reflect more solar radiation than traditional roofing materials. This reflection helps keep your home cooler in summer, reducing the need for air conditioning and lowering your energy bills.

Unlike some previous tax incentives with lifetime limits, the current energy efficiency credits offer annual opportunities through 2032. This means you can claim up to $1,200 each year for qualifying improvements, making it easier to upgrade your home in stages while maximizing tax benefits.

The key to qualifying for the metal roof tax credit 2025 is ensuring your new roof meets the Energy Star certification standards. Not all metal roofs will qualify – only those specifically designed with energy-efficient, heat-reflecting properties.

I’m Adam Kadziola from DML USA Metal Roofing, where we specialize in manufacturing Energy Star certified metal roofing products that qualify for the metal roof tax credit 2025 while providing exceptional durability and energy efficiency for Illinois homeowners.

Understanding Metal Roof Tax Credits for 2025

When you’re looking at home improvements, it helps to know the difference between tax deductions and tax credits. While deductions just lower your taxable income, tax credits directly reduce what you owe the IRS, dollar-for-dollar. This makes credits like the metal roof tax credit 2025 much more valuable for most homeowners!

Thanks to the Inflation Reduction Act of 2022, what used to be a modest lifetime credit with a $500 cap transformed into something much better – an annual credit available through 2032. This change makes energy-efficient upgrades like metal roofing significantly more attractive financially.

“Homeowners can now claim up to 30% of the cost of qualifying metal roofing materials, with a yearly maximum of $1,200,” our tax specialist at DML USA Metal Roofing often explains. “It’s a fantastic opportunity to invest in your home while keeping more money in your pocket at tax time.”

Your metal roof qualifies because it’s considered a “building envelope component” – essentially, it helps create a barrier between your comfortable indoor living space and the outside elements. But not just any metal roof will do! To qualify, your roof needs to meet specific Energy Star efficiency standards that help reduce energy use.

This credit was designed with a clear purpose: encouraging homeowners to choose materials that cut energy consumption, especially for cooling during hot Illinois summers. By reflecting more sunlight instead of absorbing it, qualified metal roofs can significantly reduce heat buildup in your attic and living spaces.

We’ve seen how these tax incentives have helped many of our Illinois customers make the switch to premium metal roofing. Many tell us that knowing about the tax credit was what finally made their decision possible financially – that $1,200 makes a real difference!

What Qualifies for the Metal Roof Tax Credit 2025

To make sure your new metal roof qualifies for the metal roof tax credit 2025, there are some specific requirements established by the Department of Energy and EPA through the Energy Star program. Here’s what matters:

Your metal roof must have Energy Star certification as a “cool roof” product. This isn’t just a fancy label – it means the roofing meets scientific standards for solar reflectance. The roof also needs specially designed pigmented coatings that reduce heat gain by reflecting sunlight away from your home rather than absorbing it.

For most homes with steep-slope roofs, these coatings need to achieve an initial solar reflectance of at least 0.25, and still maintain at least 0.15 after three years of weathering. These numbers might seem small, but they make a big difference in how much heat transfers into your home!

“Many homeowners are surprised to learn that roof color affects tax credit eligibility,” our product specialist often mentions. “While darker colors might match your home’s style better, lighter colors typically have higher reflectance values and are more likely to qualify for the credit.”

The manufacturer must provide certification documents stating that the product meets these requirements. At DML USA Metal Roofing, all our qualifying products come with the necessary paperwork to support your tax credit claim – we make it easy!

If you’re unsure about which improvements would benefit your home most, the Department of Energy certification programs can connect you with qualified home energy auditors. These professionals can assess your specific situation and confirm whether a metal roof would provide significant energy benefits for your particular home and climate zone.

Want to learn more about why metal roofing might be right for your home beyond the tax benefits? Check out our detailed guide on Why Choose Metal Roofing for more information.

How Much Can You Save with the Metal Roof Tax Credit 2025

The metal roof tax credit 2025 offers some substantial savings that can make upgrading to a metal roof much more affordable. Here’s the simple breakdown of what you can expect:

You’ll get a tax credit equal to 30% of what you spend on qualifying metal roofing materials, up to a maximum of $1,200 per year. Only the materials themselves qualify – not the installation labor costs. This is a key distinction when you’re budgeting for your project.

Let’s look at a real-world example to see how this works:

Say you’re replacing your roof and the qualifying metal roofing materials cost $8,000, with installation labor adding another $4,000, bringing your total project to $12,000. Only that $8,000 in materials is eligible for the tax credit. Calculating 30% of $8,000 gives you $2,400, but since there’s a $1,200 annual cap, that’s the credit you’ll receive on your taxes.

That $1,200 is a direct reduction in what you owe the IRS – not just a deduction from your income. It’s like getting a $1,200 discount on your taxes!

But the savings don’t stop there. The real beauty of metal roofing is in the long-term energy savings. Most homeowners see a 10-25% reduction in cooling costs after installing a qualifying metal roof. For a typical Illinois home, that could mean hundreds of dollars saved on energy bills every year.

“When talking about the metal roof tax credit 2025, we always remind folks to think beyond just the immediate tax benefit,” says our energy efficiency specialist. “Over the 50+ year lifespan of your metal roof, those energy savings really add up – potentially thousands of dollars over time.”

Another great feature of the current energy efficiency credits is that they’re available annually through 2032, unlike some previous tax incentives that had lifetime limits. This means if you’re planning several home improvements, you can strategically schedule them across different tax years to maximize your benefits.

For more information about qualifying for energy efficiency tax credits, you can visit the official Energy Star requirements page or check out the IRS information on the Energy Efficient Home Improvement Credit.

Types of Metal Roofs That Qualify for 2025 Tax Credits

When you’re considering a new roof with tax benefits in mind, it’s important to know that not every metal roof will qualify for the metal roof tax credit 2025. The IRS is quite specific about which products make the cut, focusing on energy-efficient options that genuinely reduce cooling costs and environmental impact.

Let’s explore the main types of metal roofs that typically qualify for this valuable tax credit:

1. Metal Roofs with Pigmented Coatings

These are perhaps the most common qualifying roofs we see homeowners choose. What makes them special? They feature advanced paint systems containing reflective pigments that significantly boost solar reflectance.

“Many of our customers are surprised to learn they don’t have to sacrifice style for energy efficiency,” says our color specialist at DML USA Metal Roofing. “Our pigmented coating options come in dozens of colors that meet Energy Star requirements while still looking fantastic on your home.”

These specialized coatings work by reflecting infrared radiation (the heat-producing part of sunlight) while still allowing for beautiful, vibrant colors that complement your home’s design.

2. Reflective Metal Shingles

If you love the classic look of traditional roofing but want modern energy efficiency, reflective metal shingles might be perfect for you. These products cleverly mimic the appearance of materials like slate, wood shakes, or clay tiles while providing superior energy performance.

When these shingles meet Energy Star criteria, they qualify for the metal roof tax credit 2025. The best part? Your neighbors might never guess you have a metal roof at all!

3. Standing Seam Metal Roofs

Standing seam systems are among the most recognizable and popular metal roofing options. They feature distinctive raised seams where panels join together, creating clean, modern lines that many homeowners love.

When manufactured with appropriate cool-roof coatings, these systems not only look sharp but also deliver excellent weather resistance and energy efficiency that qualifies for tax credits. They’re particularly popular in Illinois where their durability stands up to our varied weather conditions.

4. Metal Tiles and Panels with Cool Roof Technology

Advanced metal tiles and panels incorporating specialized cool roof technology can also qualify when they meet required solar reflectance values. These products often use cutting-edge coating technologies that maintain their reflectivity for years, ensuring lasting energy benefits.

“One thing that surprises many homeowners is that even darker-colored metal roofs can qualify for the tax credit,” explains our roofing specialist. “Thanks to advanced pigment technology, we can create darker colors that still reflect a significant amount of infrared radiation, which is what causes heat buildup in your attic.”

When shopping for a tax-credit-eligible metal roof, always look for proper Energy Star certification. At DML USA Metal Roofing, we clearly identify which products qualify for the metal roof tax credit 2025, making your decision process much simpler. You can explore our Metal Roofing Suppliers Near Me page to find qualified products in your area.

Beyond tax credits, our metal roofing options provide exceptional durability with outstanding resistance to fire, wind, and impact damage – crucial benefits for Illinois homeowners who face everything from summer storms to winter blizzards.

Energy Efficiency Requirements for Qualifying Metal Roofs

For your new metal roof to qualify for the metal roof tax credit 2025, it needs to meet specific energy efficiency standards. These requirements ensure the tax credit truly rewards products that deliver meaningful energy savings. Here’s what you need to know:

Solar Reflectance Index (SRI)

The Solar Reflectance Index measures how well your roof can reject solar heat. It’s a bit like sunscreen for your house! This measurement considers both solar reflectance (how well it bounces sunlight away) and thermal emittance (how quickly it releases any heat it does absorb).

For residential applications with steeper roof pitches (greater than 2:12), qualifying metal roofs need an initial solar reflectance of at least 0.25, and after three years of weathering, they must maintain at least 0.15 reflectance.

Commercial applications with flatter roofs have higher requirements – initial reflectance of at least 0.65 and three-year aged reflectance of at least 0.50.

Thermal Emittance

While solar reflectance gets most of the attention, thermal emittance is equally important. This measures how efficiently your roof releases any heat it absorbs.

“I like to explain thermal emittance with a simple example,” says our technical specialist at DML USA Metal Roofing. “Imagine two roofs that both absorb some heat during a sunny day. The one with high thermal emittance is like someone who quickly cools down after exercise, while low emittance is like someone who stays hot and sweaty for hours. You want your roof to cool down quickly once the sun sets.”

Qualifying metal roofs typically have a thermal emittance of 0.75 or higher, meaning they quickly release absorbed heat rather than transferring it into your home all evening.

Climate Zone Considerations

While the metal roof tax credit 2025 applies nationwide, the actual energy savings you’ll experience vary depending on your climate zone. In hot, sunny regions (Climate Zones 1-3), the cooling benefits are most dramatic.

Here in Illinois (Climate Zone 4), we experience both hot summers and cold winters, so our homes benefit from qualified metal roofs that balance solar reflectance with appropriate thermal performance for our mixed climate needs.

“Many Illinois homeowners tell us their air conditioners run noticeably less after installing our qualifying metal roofs,” notes our customer service team. “The summer comfort difference is immediate, but they also appreciate that metal roofing doesn’t compromise winter warmth.”

The Energy Efficient Home Improvement Credit requires that qualifying products must:

- Be installed on your primary residence in the United States

- Meet or exceed the Energy Star program requirements

- Be expected to last at least 5 years

- Include a Manufacturer’s Certification Statement confirming eligibility

At DML USA Metal Roofing, we provide all the documentation you’ll need to claim your tax credit, making the process as simple as possible.

Metal Roof Longevity and Tax Benefits

When considering the metal roof tax credit 2025, it’s worth looking beyond the immediate tax savings to understand the remarkable long-term value proposition of metal roofing.

50-60 Year Lifespan

Unlike traditional asphalt shingles that typically need replacement every 15-20 years, quality metal roofs like those we manufacture at DML USA Metal Roofing generally last 50-60 years – sometimes even longer with proper maintenance.

“I’ve had customers tell me their grandparents installed a metal roof that’s still going strong decades later,” shares our sales manager. “When you think about it, an asphalt roof might need to be replaced 2-3 times during the period a metal roof would still be performing beautifully. That’s a lot of additional expense and hassle avoided.”

This extended lifespan creates significant long-term savings that make the higher initial investment in metal roofing much more economical over the life of your home.

Reduced Replacement Frequency

The less frequently you need to replace your roof, the more benefits you receive:

Lower lifetime costs – Even with the higher upfront investment, metal roofing often costs less over the decades you’ll own your home.

Less landfill waste – Traditional roofing materials contribute millions of tons to landfills annually. Metal roofs help reduce this environmental burden.

Fewer disruptions – Anyone who’s lived through a roof replacement knows it’s not a pleasant experience. Metal roofing means fewer disruptions to your home life over the decades.

Peace of mind – There’s real value in knowing your roof will protect your home through decades of weather challenges without needing replacement.

Sustainability Benefits

Beyond energy efficiency, metal roofs offer impressive environmental credentials that many homeowners value:

Metal roofs are 100% recyclable at the end of their service life, unlike many traditional roofing materials that end up in landfills. In fact, many metal roofing products already contain a significant percentage of recycled material – at DML USA Metal Roofing, our products typically contain 25-95% recycled content, depending on the specific metal and manufacturing process.

The remarkable durability of metal roofing means fewer natural resources are consumed over time compared to roofing materials that require frequent replacement. This reduced environmental impact is becoming increasingly important to environmentally conscious homeowners.

Tax Benefits Over Time

While the immediate metal roof tax credit 2025 provides a compelling financial incentive, the tax benefits may extend beyond the initial installation:

Your home’s value may increase due to energy-efficient improvements like qualifying metal roofs, potentially offering tax advantages when selling your home. The current structure of energy efficiency tax credits allows for annual claims through 2032, so if you complete your roofing project in stages, you might qualify for credits across multiple tax years.

Don’t forget about state incentives too – in addition to federal tax credits, some states offer their own incentives for energy-efficient home improvements, potentially multiplying your savings.

“When we talk with customers about the total value of metal roofing, we encourage them to consider the complete picture,” explains our roofing consultant. “The metal roof tax credit 2025 is just the beginning of a long relationship with a roof that will protect your home, save energy, and look beautiful for decades to come.”

How to Claim the Metal Roof Tax Credit in 2025

Ready to claim your metal roof tax credit 2025? I know tax paperwork can feel overwhelming, but I promise it’s more straightforward than you might think. Let’s walk through the process together, step by step.

First, you’ll need to make sure your metal roof installation qualifies. This credit only applies to your primary residence – not that vacation home or rental property you might also own. The installation must be completed during the 2025 tax year, and most importantly, your new roof must meet those Energy Star requirements we discussed earlier, with the appropriate pigmented coatings that reflect heat.

“Most of our customers are surprised by how simple the process is once they have the right documentation,” says our tax specialist at DML USA Metal Roofing. “The key is keeping everything organized from the start.”

When it comes to documentation, here’s what you’ll need to gather:

- Your receipts and invoices that clearly separate material costs from installation costs (remember, only materials qualify!)

- The Manufacturer’s Certification Statement confirming your roof meets energy efficiency requirements

- Energy Star certification documentation for your specific roofing product

- Photos of your completed installation (not required by the IRS but helpful for your records)

The actual claiming happens on IRS Form 5695, the Residential Energy Credits form. You’ll calculate your credit amount (30% of those eligible material costs, up to the $1,200 annual limit), complete Part II of the form for the Energy Efficient Home Improvement Credit, and then transfer that amount to your Form 1040 or 1040-SR.

“One common mistake we see is homeowners claiming installation costs as part of the credit,” our tax specialist notes. “The IRS is very clear that only the materials themselves qualify, not the labor to install them.”

Once you’ve completed Form 5695, simply include it with your federal tax return. If you’re filing electronically, your tax software should prompt you to complete this form when you indicate you’re eligible for residential energy credits.

Even after filing, keep all your documentation for at least seven years. This includes all receipts, the Manufacturer’s Certification Statement, your completed tax forms, and any correspondence with us or other contractors regarding your roof’s tax credit eligibility.

At DML USA Metal Roofing, we make this process easier by providing comprehensive documentation packages specifically designed to support your metal roof tax credit 2025 claims. We’ve refined our approach over years of helping Illinois homeowners, so each qualifying product comes with clear certification statements and guidance for tax filing.

This credit is non-refundable, meaning it can reduce your tax liability to zero but won’t generate a refund beyond that. However, depending on IRS regulations for the specific tax year, any unused portion might be carried forward to future tax years – another good reason to keep those records organized!

Documentation Required for Metal Roof Tax Credit Claims

When it comes to claiming your metal roof tax credit 2025, having the right paperwork isn’t just helpful – it’s essential. The IRS may request verification of your claim, and proper documentation can mean the difference between a smooth process and potential headaches down the road.

Let’s break down exactly what you’ll need to keep in your files:

First and foremost, you’ll need solid proof of purchase. This includes itemized receipts or invoices that clearly separate the cost of your qualifying metal roofing materials from installation labor and other expenses. You’ll also want to keep proof of payment – whether that’s canceled checks, credit card statements, or payment receipts – and verification that the materials were purchased during the eligible tax year.

“We always recommend asking your contractor for an itemized invoice that specifically breaks out the cost of the roofing materials,” our financial specialist at DML USA Metal Roofing advises. “This makes calculating your eligible credit amount much simpler and provides clear documentation if the IRS has questions.”

Energy Star certification documentation is another crucial piece of the puzzle. You’ll want to keep product specification sheets showing the Energy Star certification, any Energy Star labels or documentation with specific model numbers, and paperwork confirming the solar reflectance values meet minimum requirements. At DML USA Metal Roofing, all our qualifying products come with clearly marked Energy Star certification information to include with your tax records.

Perhaps the most important document is the Manufacturer’s Certification Statement. This must include a statement that the product qualifies for the energy efficiency tax credit, the specific criteria it meets (like those solar reflectance values), the manufacturer’s name and contact information, and identification of the specific product installed on your home.

“Without the Manufacturer’s Certification Statement, the IRS may disallow your credit even if the product actually qualifies,” our product specialist explains. “That’s why we provide this statement automatically with all our tax-credit-eligible products.”

You’ll also want documentation verifying when the installation was completed. This could be a completion certificate, final inspection documentation, your contractor’s statement confirming the completion date, or building permits showing the project timeline (if applicable in your area).

The tax credit applies to the year in which the installation was completed, not when you made the payment. If you paid for your roof in December 2024 but the installation wasn’t finished until January 2025, the credit would apply to your 2025 tax return.

“We often see confusion about which tax year applies when a project spans the new year,” our installation coordinator notes. “The key date is when the installation was completed and the roof was put ‘in service,’ not when you signed the contract or made the payment.”

For our Illinois homeowners, we recommend keeping a physical folder with all these documents together, along with photographs of your completed roof. While photos aren’t required by the IRS, they provide helpful supporting documentation if questions arise.

At DML USA Metal Roofing, we’ve developed a comprehensive “Tax Credit Documentation Package” that we provide to all customers purchasing qualifying products. This package includes all the necessary forms and information organized specifically to support your metal roof tax credit 2025 claim, taking the guesswork out of the process.

Combining Metal Roof Tax Credits with Other Incentives

Why settle for just one savings opportunity when you could potentially stack several? One of the smartest strategies for maximizing your return on investment is combining the federal metal roof tax credit 2025 with other available incentives. This approach can dramatically reduce your overall costs while upgrading your home with energy-efficient metal roofing.

Many Illinois homeowners don’t realize that state-level programs can often be claimed alongside the federal tax credit. The Illinois Energy Efficiency Programs, administered through utilities like ComEd and Ameren, sometimes offer rebates for energy-efficient improvements including cool roofing. The Illinois Clean Energy Community Foundation also periodically offers grants and incentives that might apply to your metal roof project.

“Illinois homeowners should definitely check with both state agencies and their local utilities,” our energy efficiency specialist recommends. “These programs change frequently, and when you combine state incentives with the federal metal roof tax credit 2025, we’ve seen customers reduce their net costs by 40% or more in some cases.”

Don’t overlook local incentives either. Many municipalities offer their own programs, like property tax reductions for energy-efficient improvements, permit fee waivers for green building projects, or city-specific rebate programs. Throughout the Chicago area, several communities have implemented green building incentives that work beautifully alongside the federal tax credit. Our team stays current on these local opportunities and can help identify programs specific to your neighborhood.

Your utility company might be another source of savings. Companies like ComEd often offer direct rebates for qualifying cool roof installations, energy audit programs that may identify additional incentives, or reduced rate programs for homes with comprehensive energy-efficient features.

“The utility companies have a vested interest in reducing peak energy demand, especially during hot summer months,” our customer service representative explains. “That’s why they’re often willing to provide financial incentives for improvements like reflective metal roofing that reduce cooling loads.”

At DML USA Metal Roofing, we occasionally offer our own special promotions or rebates on energy-efficient metal roofing products. These manufacturer incentives typically can be combined with government tax credits and rebates, creating even more savings.

To maximize your total benefits, I recommend this approach: First, research all available incentives before starting your project. Confirm the eligibility requirements for each program to ensure your project qualifies. Document everything carefully, as different programs may require different forms of proof. Consider timing, since some incentives have limited funding or expiration dates. And finally, consult with specialists who understand how different programs interact.

“The key to maximizing incentives is planning ahead,” our project consultant advises. “We help our customers develop a comprehensive incentive strategy before their project begins to ensure they don’t miss any opportunities for savings.”

By thoughtfully combining the metal roof tax credit 2025 with other available incentives, you can significantly reduce the upfront cost of installing a premium metal roof while still enjoying all the long-term benefits – improved durability, improved energy efficiency, increased home value, and the satisfaction of knowing you’ve made an environmentally responsible choice.

Additional Energy Efficiency Tax Credits for Homeowners in 2025

When you’re thinking about upgrading your home with an energy-efficient metal roof, you’re actually opening the door to a whole world of potential tax savings. The metal roof tax credit 2025 is fantastic on its own, but it’s just one piece of a much larger energy efficiency puzzle that could save you thousands.

Residential Clean Energy Credit

If you’re thinking about going beyond just a metal roof, the Residential Clean Energy Credit offers some seriously impressive benefits. Unlike the metal roof tax credit 2025 which caps at $1,200 per year, this credit has no upper limit and offers a whopping 30% credit through 2032 (though it will step down to 26% in 2033 and 22% in 2034).

“Many of our customers are pairing their new metal roofs with solar panels,” says our energy solutions expert at DML USA Metal Roofing. “It’s really a perfect match – the metal roof provides an ideal mounting surface for the panels, and you can claim both tax credits at the same time.”

This credit covers a variety of renewable technologies beyond just solar electric systems. You can also get the 30% credit for solar water heating, fuel cells, small wind energy systems, geothermal heat pumps, and even battery storage technology. For most Illinois homeowners, solar electric systems make the most sense, especially when paired with a new metal roof.

The best part? There’s no cap on this credit – if you install a $20,000 solar system, you could see a $6,000 tax credit, on top of whatever you receive for your metal roof. That’s real money back in your pocket!

Home Energy Audit Credit

Before jumping into any major home improvement project, it often makes sense to understand exactly where your energy dollars are going. That’s where a professional home energy audit comes in – and yes, there’s a tax credit for that too!

You can claim 30% of the cost of a home energy audit, up to $150. While that might not sound like much compared to the other credits, it’s money well spent. A good auditor will identify exactly which improvements will give you the biggest bang for your buck.

“I always tell people that an energy audit is like getting a roadmap for your home’s efficiency journey,” explains our efficiency consultant. “The $150 credit makes this service much more affordable, and the resulting recommendations can help you make smarter decisions about everything else – including your new metal roof.”

The audit needs to be conducted by a qualified home energy auditor who will provide a written assessment of your home’s energy profile. They’ll check everything from insulation levels to air leakage points, helping you understand how all your home’s systems work together.

Insulation Improvements Credit

If your energy audit reveals that your insulation needs upgrading (and many do), there’s good news – insulation improvements also qualify for a 30% tax credit, up to the $1,200 annual limit. This includes traditional insulation materials, air sealing products, and even weather stripping.

We’ve found that pairing a new metal roof with proper attic insulation creates a powerful combination for energy savings. The reflective metal roof keeps heat from entering through the top of your home, while good insulation prevents the heat that does get in from moving into your living spaces.

“It’s like wearing both a hat and sunscreen on a hot day,” our installation specialist likes to say. “The metal roof is your hat, blocking the sun’s rays, while insulation is your sunscreen, providing that second layer of protection.”

To qualify, your insulation materials need to meet the 2009 International Energy Conservation Code standards, which most modern insulation products do.

HVAC System Upgrades

Your heating and cooling system works hand-in-hand with your roof and insulation to keep your home comfortable. Upgrading to more efficient HVAC equipment can further improve the benefits of your new metal roof – and yes, there are tax credits for that too!

You can claim 30% of the cost of energy-efficient heating and cooling equipment. Most HVAC upgrades fall under the standard $1,200 annual limit, but there’s a special provision for heat pumps and biomass stoves that allows for up to $2,000 in tax credits annually.

“When customers combine a new metal roof with an upgraded HVAC system, they often see dramatic improvements in comfort and significant reductions in their utility bills,” notes our systems specialist. “The roof keeps excess heat out, and the efficient HVAC system handles the rest more economically.”

Windows and Doors Credits

To complete your home’s energy-efficient envelope, don’t forget about windows and doors. These also qualify for the 30% tax credit, though with specific limits: up to $250 per door (with a maximum of $500 for all doors) and up to $600 total for windows and skylights.

Like your metal roof, these products must be Energy Star certified to qualify for the tax credit. The combination of a reflective metal roof, proper insulation, and energy-efficient windows and doors creates a complete thermal barrier around your home.

Solar and Metal Roof Integration Tax Benefits

If you’re looking to maximize both energy savings and tax benefits, the combination of solar panels and a metal roof is hard to beat. This pairing makes perfect sense for several practical reasons.

First, the lifespans match up beautifully. A quality metal roof from DML USA Metal Roofing will last 50+ years, while most solar panels are warranted for 25-30 years. This means you won’t have to remove and reinstall your solar system for a roof replacement – a costly process that owners of asphalt-shingled roofs often face.

Second, metal roofs provide ideal mounting options for solar panels. “With standing seam metal roofs, we can attach solar panels without making a single penetration in the roof surface,” explains our renewable energy specialist. “This maintains the watertight integrity of your roof while supporting the solar array.”

Third, metal roofing provides the structural strength needed to support solar panels without additional reinforcement. The result is a cleaner installation and lower overall costs.

From a tax perspective, this combination is particularly powerful. You can claim both the metal roof tax credit 2025 (30% of material costs up to $1,200) and the Residential Clean Energy Credit (30% of the entire solar system cost with no dollar cap).

Beyond traditional solar panels, we’re seeing growing interest in integrated systems like solar shingles and building-integrated photovoltaics (BIPV). These innovative products function as both roofing materials and solar collectors. While the tax treatment of these dual-purpose products can be complex, many qualify for both credits – though you should always consult with a tax professional about your specific situation.

One of our Illinois customers recently shared their experience: “We installed a qualifying metal roof from DML USA Metal Roofing for $16,000 (including $10,000 in materials) and added a solar panel system for $20,000. We received a $1,200 tax credit for the metal roof materials and a $6,000 credit for the solar system. The combined $7,200 in federal tax credits, plus ongoing energy savings and increased home value, made this a very attractive investment.”

Home Energy Audit Credits and Metal Roofing

If you’re serious about maximizing the benefits of your new metal roof, starting with a professional home energy audit makes a lot of sense. This assessment helps you understand how a new roof fits into your home’s overall energy profile and identifies additional improvements that might improve your roof’s performance.

A comprehensive energy audit examines your entire home as a system. The auditor will identify areas of energy loss, assess your current insulation levels, evaluate attic ventilation, and provide prioritized recommendations for improvements. They’ll also provide a cost-benefit analysis of various energy upgrades, including metal roofing.

“Many homeowners don’t realize how interconnected their home’s systems are,” explains our energy consultant. “Your roof doesn’t work in isolation – its performance is affected by your attic ventilation, insulation levels, and even how air moves through your home. An energy audit helps you see the big picture.”

The tax credit covers 30% of the audit cost, up to $150, and this credit is separate from the $1,200 annual limit for other home improvements. To qualify, the audit must be performed by a certified professional who will provide a written report and their taxpayer identification or certification number.

At DML USA Metal Roofing, we’ve built relationships with certified energy auditors throughout Illinois who understand how roofing systems interact with other home components. We can help connect you with qualified professionals who will provide valuable insights before you invest in a new roof.

The most effective approach to home energy efficiency takes a whole-home perspective. Start with an audit to establish baseline performance and priorities. Address fundamental issues like air sealing and insulation to create a solid foundation. Then install a qualifying metal roof that meets the requirements for the metal roof tax credit 2025. Consider additional improvements like windows, doors, or HVAC upgrades based on your audit recommendations. And be sure to document all improvements carefully for appropriate tax credits.

One of our Chicago-area customers shared their experience: “The home energy audit revealed that our attic insulation was inadequate and our ventilation was poorly designed. By addressing these issues before installing our new metal roof, we created a complete thermal barrier system. The audit cost $400, giving us a $120 tax credit, and the recommended improvements qualified for additional credits. Our summer cooling costs dropped by nearly 30% after completing all the suggested upgrades, including the new metal roof.”

By combining a professional energy audit with a qualifying metal roof installation, you’re taking a smart, systematic approach to home energy efficiency that maximizes both immediate tax benefits and long-term energy savings. And at DML USA Metal Roofing, we’re here to help you steer every step of the process.

Frequently Asked Questions About Metal Roof Tax Credits

When homeowners start exploring the metal roof tax credit 2025, they often have similar questions. As we’ve helped countless Illinois families steer these tax benefits, we’ve compiled the most common questions we hear at job sites and during consultations.

Are Installation Costs Included in the Metal Roof Tax Credit 2025?

No, the installation costs don’t qualify for the tax credit. This surprises many homeowners, but the IRS rules are clear: only the cost of the qualifying metal roofing materials themselves can be included in your tax credit calculation.

“I always make sure to explain this distinction up front,” says Tom, our installation coordinator. “It helps prevent disappointment later when tax season arrives.”

When we prepare quotes at DML USA Metal Roofing, we clearly separate the material costs from labor costs specifically to make your tax filing easier. The materials—the actual metal panels, trim, and fasteners—are what qualify for the 30% credit (up to the $1,200 limit). The labor to install them, delivery fees, tools, and other related expenses aren’t eligible.

Even though installation costs aren’t covered, the overall value of a metal roof remains impressive when you consider the long-term energy savings, minimal maintenance, and extraordinary lifespan. Many of our customers tell us that while the tax credit was the initial attraction, the lasting performance is what truly makes them happy with their investment.

To make sure you’re properly documenting your eligible expenses, ask us for an itemized invoice that clearly separates materials from labor. Keep this documentation, along with your Manufacturer’s Certification Statement confirming tax credit eligibility, with your tax records for at least seven years.

Can I Claim the Metal Roof Tax Credit for a Rental Property?

This is one of the most frequent questions we hear, and unfortunately, the answer is generally no. The metal roof tax credit 2025 specifically applies to your primary residence—the home where you actually live most of the time.

“I had a customer last year who owned three properties and wanted to claim the credit on all of them,” recalls Sarah from our customer service team. “I had to explain that only her main home would qualify.”

The primary residence requirement means:

- The home must be owned by you (not rented)

- It must be your main dwelling where you live most of the time

- It must be an existing home, not new construction

- It must be located in the United States

If you use part of your home for business purposes, things get a bit more complicated. The portion used exclusively for business typically doesn’t qualify, but spaces used for both personal and business purposes might still be eligible for the full credit. This is definitely a situation where consulting with a tax professional is worth the investment.

While rental properties don’t qualify for the metal roof tax credit 2025, there are other tax benefits available to property investors. The cost of a new metal roof on a rental property can typically be depreciated over its useful life, and certain repairs might qualify as immediate business expenses. These depreciation strategies can provide significant tax advantages even without the energy tax credit.

How Does the Metal Roof Tax Credit Impact My Overall Tax Liability?

The metal roof tax credit 2025 is what’s called a “non-refundable” tax credit. This means it can reduce your tax bill dollar-for-dollar up to the amount you owe, but it won’t generate a refund beyond that point.

“Think of it as a gift card for your taxes,” explains Mike, our financial specialist. “If you have a $3,000 tax bill and a $1,200 credit, you’ll only need to pay $1,800. But if your tax bill is only $800, you can only use $800 of the credit—the rest doesn’t create a refund.”

This is why timing can be so important. If you’re planning to retire soon or expect significant income changes, you might want to coordinate your metal roof installation with a year when you’ll have enough tax liability to benefit from the full credit.

Here’s a real-world example from one of our customers in Naperville:

“We were planning to withdraw money from our IRA to help pay for our grandkids’ college tuition. Our tax advisor suggested we do the roof the same year since our tax liability would be higher than normal. The timing worked perfectly—we got the full $1,200 credit because we had enough tax liability to offset.”

The ability to carry forward unused portions of the credit to future tax years depends on current tax regulations, which can change. For the most accurate information about the metal roof tax credit 2025, we always recommend consulting with a tax professional familiar with the latest IRS guidelines.

Smart tax planning strategies include:

Timing your purchase for a year when you expect higher tax liability, considering how the metal roof credit will interact with other tax credits you might claim, and working with a tax advisor to develop a strategy that maximizes your benefits.

While we at DML USA Metal Roofing are experts in metal roofing systems, we always encourage our customers to partner with tax professionals to ensure they receive the maximum benefit from this valuable incentive. The metal roof tax credit 2025 is a significant opportunity, but like most tax benefits, getting the most from it requires some planning.

Conclusion

As we wrap up our journey through metal roof tax credits, I hope you’ve gained valuable insights into this significant opportunity for Illinois homeowners. The metal roof tax credit 2025 isn’t just a nice little tax break – it’s a meaningful financial incentive that makes premium metal roofing more accessible while rewarding your choice to improve your home’s energy efficiency.

Throughout our conversations with homeowners across Illinois, we’ve found that understanding the practical aspects of this credit makes all the difference in making a confident decision. Let’s recap what we’ve learned:

The metal roof tax credit 2025 offers you 30% of the cost of qualifying metal roofing materials, up to $1,200. It’s the materials only – not installation costs – that qualify, but that still represents substantial savings on your investment.

To qualify, your metal roof needs those special pigmented coatings that meet Energy Star requirements. These aren’t just any metal roofs – they’re specifically designed with solar reflectance properties that keep your home cooler and reduce energy consumption.

Documentation is your friend when tax time rolls around. Keep your Manufacturer’s Certification Statement (which we always provide with our qualifying products), your itemized receipts showing material costs separate from installation, and don’t forget to complete IRS Form 5695 when you file.

One thing we often remind our customers at DML USA Metal Roofing: this credit applies only to your primary residence in the United States. Your vacation home or rental properties won’t qualify, though there are other tax advantages for those properties worth exploring with your tax professional.

What makes this credit particularly exciting is that unlike previous versions with lifetime limits, the current program makes the credit available annually through 2032. This gives you flexibility in planning larger home improvement projects over multiple years.

Beyond the immediate tax savings, I’ve seen how investing in a quality metal roof transforms homes and provides peace of mind. When summer temperatures soar in Illinois, our customers report noticeable differences in cooling costs. When severe storms roll through, they rest easy knowing their roof can handle whatever Mother Nature throws at it.

The numbers tell a compelling story: a premium metal roof’s 50-60 year lifespan dramatically outperforms traditional roofing’s 15-20 years. That means fewer replacements, less waste in landfills, and significant long-term savings. Plus, when you eventually sell your home, that durable, energy-efficient roof becomes a valuable selling point.

“I never thought I’d get excited about a roof,” one of our customers recently told me, “but knowing it’s the last roof I’ll ever need to buy for this house – and getting a tax credit to boot – that’s something worth talking about!”

As we look toward 2025 and beyond, energy efficiency will continue to be a priority in national policy and homeowner decisions. By taking advantage of the metal roof tax credit 2025, you’re not just making a smart financial move – you’re investing in your home’s future and contributing to broader environmental goals.

At DML USA Metal Roofing, we take pride in manufacturing high-quality metal roofing products right here in Illinois that not only qualify for these valuable tax credits but also stand the test of time. Our team stays up-to-date on all tax credit requirements and energy efficiency standards to ensure our products deliver maximum value.

We’d love to help you explore our range of Energy Star certified metal roofing options that qualify for the metal roof tax credit 2025. Whether you’re drawn to the classic look of metal shingles or the clean lines of standing seam, we have options that will improve your home’s appearance while delivering decades of protection.

The tax credit makes quality metal roofing more affordable than ever, but the true value comes from years of protection, energy savings, and the peace of mind that only a premium metal roof can provide. Make 2025 the year you invest in your home’s future with a tax-credit-eligible metal roof from DML USA Metal Roofing.