When it comes to improving your home’s energy efficiency, one standout option that brings multiple benefits is the energy efficient roofing tax credit. This tax credit serves as an enticing incentive for homeowners looking to upgrade their roofs while also embracing sustainability.

Key Takeaways:

- Energy efficient roofing qualifies for federal tax credits.

- Eligible materials include metal roofing and cool asphalt roofing.

- Keep accurate records and file Form 5695 to claim credits.

Switching to energy-efficient materials like metal roofing or cool asphalt not only helps reduce your carbon footprint but also offers potential tax savings. These roofing options are designed to improve energy efficiency and mimic classic styles, ensuring both aesthetic appeal and functionality for your home.

I’m Adam Kadziola, and as an expert in energy efficient roofing tax credit solutions, I’ve dedicated years to navigating these incentives. My in-depth understanding of roofing materials and tax credits allows me to provide clear insights to help you make informed decisions about your home improvements.

Understanding Energy-Efficient Roofing

Energy-efficient roofing is more than just a trend; it’s a smart investment for homeowners. Let’s break down what makes a roof energy-efficient and why it matters.

Cool Roofs

Cool roofs are designed to reflect more sunlight and absorb less heat than a standard roof. This is achieved through special reflective materials or coatings. By keeping the roof surface cooler, these roofs help reduce the amount of heat transferred into the building.

Benefits of Cool Roofs:

– Lower Energy Bills: By reducing the need for air conditioning, cool roofs can significantly cut down on energy costs.

– Increased Comfort: Homes with cool roofs stay cooler during hot months, making living spaces more comfortable.

– Extended Roof Lifespan: Lower temperatures reduce thermal expansion and contraction, potentially extending the roof’s life.

Solar Reflectance and Thermal Emittance

Two key properties define the effectiveness of cool roofs: solar reflectance and thermal emittance.

-

Solar Reflectance: This measures how much sunlight a roof can reflect. A higher solar reflectance means less heat is absorbed. Think of it as the roof’s ability to act like a mirror, bouncing sunlight away.

-

Thermal Emittance: This refers to how efficiently a roof can release absorbed heat. A high thermal emittance allows the roof to cool down faster after the sun sets.

Together, these properties help keep buildings cooler and reduce energy usage.

Why Choose Energy-Efficient Roofing?

Switching to energy-efficient roofing can lead to significant cost savings and environmental benefits. Homeowners can enjoy a cooler home, lower energy bills, and even potential tax credits like the energy efficient roofing tax credit for using materials such as metal or cool asphalt.

By understanding these concepts, you can make informed decisions about which roofing materials to choose for your home. Energy-efficient options not only improve your home’s comfort but also contribute to a sustainable future.

Next, let’s dive into the Energy Efficient Roofing Tax Credit and find how you can benefit from these savings.

Energy Efficient Roofing Tax Credit

When you invest in energy-efficient roofing, you’re not just making a smart choice for your home. You could also qualify for the energy efficient roofing tax credit. Let’s explore what this means, who is eligible, and how to make the most of it.

What is the Energy Efficient Roofing Tax Credit?

The energy efficient roofing tax credit is a government incentive designed to encourage homeowners to upgrade to more sustainable roofing options. This credit helps reduce the cost of installing energy-efficient roofs by allowing you to deduct a portion of the expenses from your federal taxes.

Key Points:

– The credit can cover up to 30% of your installation costs for qualifying roofing improvements.

– It applies to materials like metal roofing or cool asphalt, known for their energy-saving properties.

– This is part of a broader initiative to promote energy efficiency and reduce overall energy consumption.

Eligibility for the Tax Credit

Not every roofing project qualifies for the tax credit. Here’s what you need to know about eligibility:

-

Primary Residence: The roofing must be installed on your primary residence. Vacation homes and rental properties typically do not qualify.

-

Qualifying Materials: The roof must use materials that meet energy efficiency standards. Options like metal roofing or cool asphalt are often eligible due to their reflective properties and ability to reduce heat absorption.

-

Installation Year: The credit is available for the tax year in which the roofing was installed, not when it was purchased. So, make sure to plan your project accordingly.

-

Documentation: Keep all receipts and documentation from your installation. You’ll need these when filing your taxes to prove eligibility.

How to Maximize Your Savings

To make the most of the energy efficient roofing tax credit, consider the following tips:

-

Consult a Professional: Work with a knowledgeable roofing contractor who understands which materials qualify for the credit. They can guide you in choosing the best options for your home.

-

Stay Informed: Tax credits and incentives can change. Stay updated on any changes to the program to ensure you don’t miss out on potential savings.

-

Plan Ahead: Since the credit applies to the year of installation, timing your project correctly can impact your tax return.

By taking advantage of this tax credit, you can offset some of the costs of upgrading your roof while contributing to a more sustainable future.

Next, we’ll explore how to claim the Energy Efficient Roofing Tax Credit and steer the IRS guidelines to ensure you get the benefits you’re entitled to.

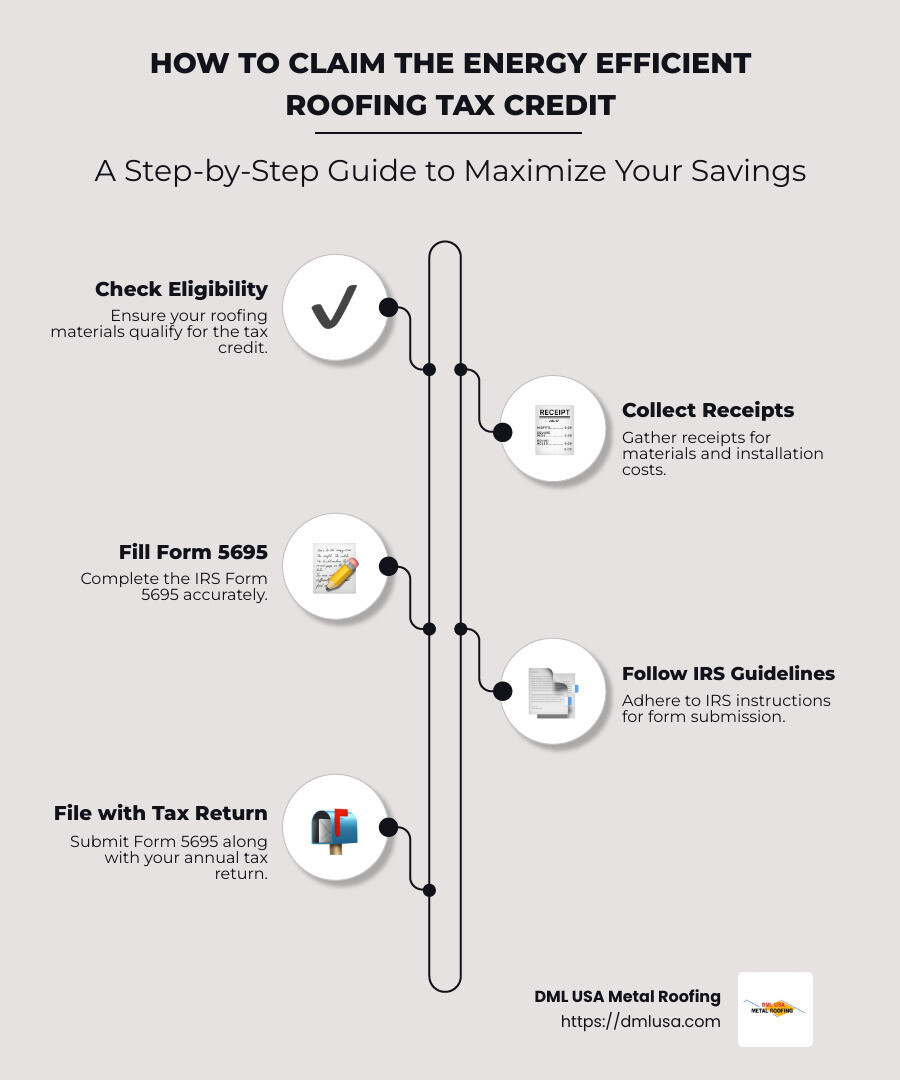

How to Claim the Energy Efficient Roofing Tax Credit

Claiming the energy efficient roofing tax credit is a straightforward process, but it requires careful attention to detail. Here’s a step-by-step guide to help you steer the IRS guidelines and maximize your savings.

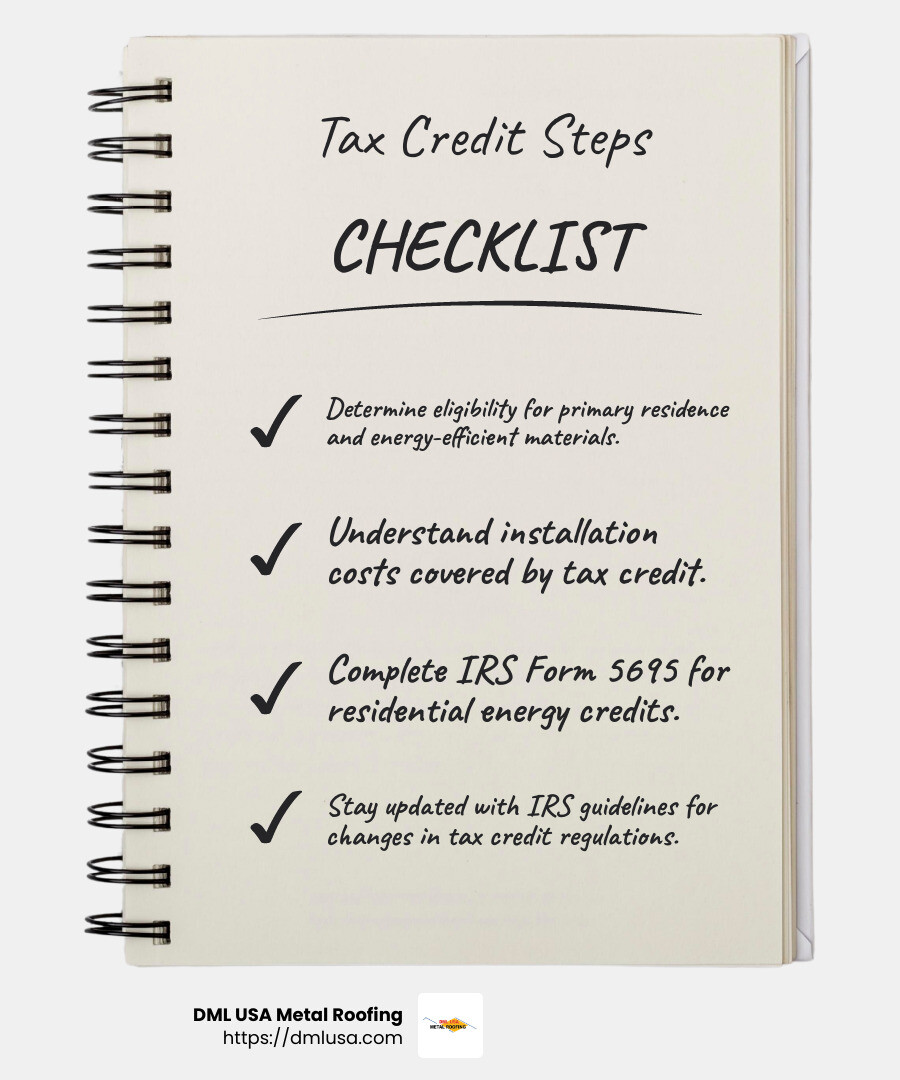

Step 1: Determine Eligibility

Before you can claim the credit, ensure your roofing project meets the eligibility criteria. The roof must be installed on your primary residence, and the materials used should meet energy efficiency standards, such as metal roofing or cool asphalt.

Step 2: Understand Installation Costs

The tax credit covers up to 30% of your installation costs. This includes expenses for materials and labor associated with the installation of the energy-efficient roofing. Keep detailed records of all costs incurred during the project, as you’ll need these for your tax filing.

Step 3: Complete IRS Form 5695

To claim your credit, you’ll need to fill out Form 5695, “Residential Energy Credits.” Here’s how to tackle it:

-

Part I: This section is for calculating your residential energy credits. Since you’re focusing on roofing, you’ll primarily fill out Line 2, which deals with the cost of energy-efficient roofing materials.

-

Line 5: Total the costs from Lines 1 through 4 to get your total qualified solar electric property costs. This is crucial for determining your credit amount.

-

Documentation: Attach any necessary documentation, such as receipts and the Manufacturer’s Certification Statement, which proves the eligibility of your roofing materials.

Step 4: File Your Tax Return

Transfer the credit amount from Form 5695 to your Individual Income Tax Return (Form 1040). Ensure you attach Form 5695 when you submit your tax return to the IRS. This step is critical to validate your claim.

Step 5: Keep Updated with IRS Guidelines

Tax regulations can change. It’s vital to stay informed about any updates to the energy efficient roofing tax credit. Regularly check the IRS website or consult a tax professional to ensure you’re aware of any new guidelines or requirements.

By following these steps, you can successfully claim the tax credit and enjoy the financial benefits of your investment in energy-efficient roofing. Next, let’s dig into the broader benefits of energy-efficient roofing, including cost savings, environmental impact, and increased home value.

Benefits of Energy-Efficient Roofing

Investing in energy-efficient roofing isn’t just about saving on taxes. It’s also a smart way to cut costs, help the environment, and boost your home’s value. Let’s break it down.

Cost Savings

One of the biggest perks of an energy-efficient roof is the money you’ll save on energy bills. Metal roofing is designed to reflect more sunlight and absorb less heat. This means your home stays cooler in the summer, reducing your need for air conditioning and cutting your energy costs. Over time, these savings can add up significantly, making the initial investment well worth it.

Environmental Impact

Choosing energy-efficient roofing materials is a great way to reduce your carbon footprint. By using materials that reflect heat and improve insulation, you’re helping to lower the overall energy consumption of your home. This means less reliance on fossil fuels and a smaller impact on the environment. Plus, metal roofing is often made from recycled materials and can be recycled again at the end of its life, making it a sustainable choice.

Increased Home Value

An energy-efficient roof can also increase your home’s resale value. Buyers are increasingly looking for homes with green features that lower utility costs and are better for the planet. According to recent studies, homes with energy-efficient upgrades, like a new roof, can sell faster and at higher prices than those without. This makes energy-efficient roofing not just a cost-saving measure, but also a solid investment in your home’s future.

By choosing energy-efficient roofing, you’re making a smart decision that benefits your wallet, the environment, and your home’s marketability. Next, we’ll tackle some common questions about the energy efficient roofing tax credit to ensure you have all the information you need to make the best choice for your home.

Frequently Asked Questions about Energy Efficient Roofing Tax Credit

Do energy-efficient roofs qualify for tax credits?

Yes, they do! If you’re thinking about upgrading to an energy-efficient roof, you might be eligible for a tax credit. The IRS offers these credits to encourage homeowners to make energy-saving improvements. To qualify, your new roof must meet certain energy efficiency standards. For instance, it should be Energy Star certified, which means it reflects more sunlight and absorbs less heat. This helps reduce energy use, especially in hot climates.

This credit is generally available for your primary residence. So if you’re considering this for a second home or a rental property, you might not qualify. Always check the latest IRS guidelines or consult a tax professional to ensure your roof meets the necessary criteria.

Can you claim the cost of a new roof on your taxes?

While you can’t claim the full cost of a new roof as a tax deduction, you can benefit from the energy efficient roofing tax credit. This credit applies to the cost of materials, not installation. This credit is not a deduction. A deduction reduces your taxable income, whereas a credit directly reduces your tax bill.

If you use part of your home for business, you might be eligible for a partial deduction. This could be the case if you have a home office. Again, it’s best to consult a tax advisor to see what applies to your situation.

Are there any rebates for a new roof?

Yes, there can be! Apart from federal tax credits, many states offer rebate programs and other incentives for energy-efficient home improvements. For example, California is known for its robust incentives to encourage energy efficiency. These programs can vary widely, so it’s worth researching what’s available in your area.

Rebates can help offset the initial cost of your new roof, making the upgrade more affordable. Just make sure to check the specific requirements and deadlines for any rebates you plan to apply for. Typically, these programs require proof of purchase and installation, so keep all your receipts and documentation handy.

By understanding these tax credits, deductions, and rebates, you can make the most of your investment in an energy-efficient roof. Next, we’ll dive into how you can actually claim these credits and what forms you’ll need to fill out.

Conclusion

Choosing an energy-efficient roof is not just a smart choice for your home but also for your wallet. At DML USA Metal Roofing, we specialize in providing durable and maintenance-free metal roofing solutions that qualify for energy tax credits. Our products are designed to stand the test of time, offering high resistance to fire, wind, and impact, which means you’ll enjoy peace of mind knowing your roof is built to last.

Energy tax credits are a fantastic way to offset the initial cost of installing a new roof. By opting for energy-efficient materials, you can not only reduce your energy bills but also take advantage of government incentives that make these upgrades more affordable. With a tax credit, a portion of your roofing expenses comes back to you, making it easier to invest in a sustainable future.

Our metal roofs are not only tough but also energy-efficient, helping you save up to 40% on summer cooling costs. Plus, with a 50-year warranty, you can rest assured your investment is protected for decades to come.

If you’re considering an upgrade, now is the perfect time to explore the benefits of energy-efficient roofing. Visit our products page to learn more about how our roofing solutions can help you maximize your savings and improve your home’s value.

At DML USA Metal Roofing, we’re committed to helping you make informed decisions that benefit both your home and the environment. Reach out to us today to find how you can take advantage of these incredible energy tax credits while enjoying the long-lasting benefits of a high-quality metal roof.