energy star shingles tax credit: 7 Powerful Ways to Save 2025

Understanding Energy Star Shingles Tax Credits in 2024

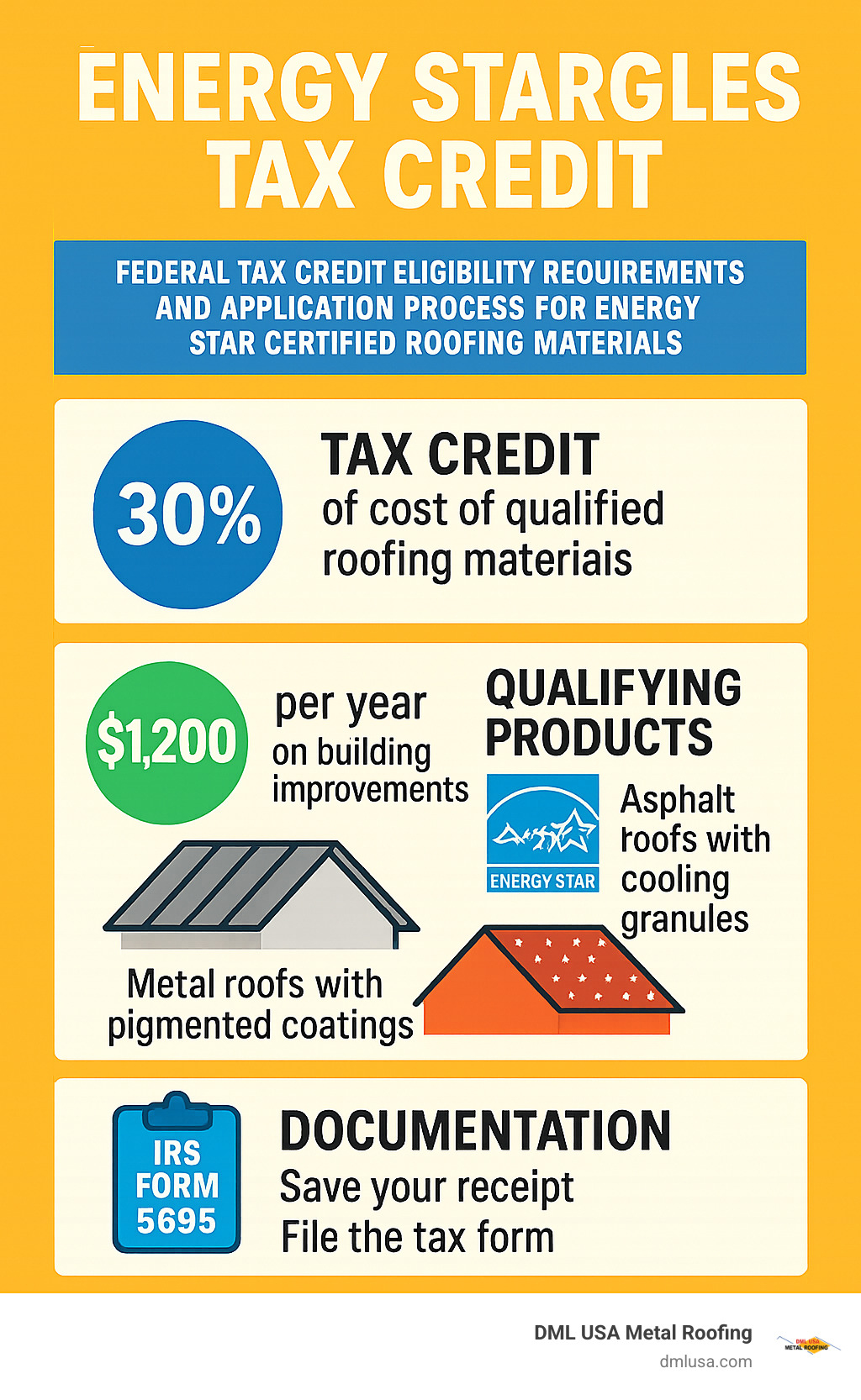

The energy star shingles tax credit is a federal tax incentive that allows homeowners to save money when installing energy-efficient roofing materials. Here’s what you need to know:

| Energy Star Shingles Tax Credit: Quick Facts |

|---|

| Credit Amount: 30% of the cost of qualified roofing materials |

| Annual Limit: Up to $1,200 for building envelope improvements |

| Eligible Materials: Energy Star certified metal roofs with pigmented coatings or asphalt roofs with cooling granules |

| Eligibility: Primary residences only (not new construction or rentals) |

| Valid Through: December 31, 2032 |

| Tax Form: IRS Form 5695 |

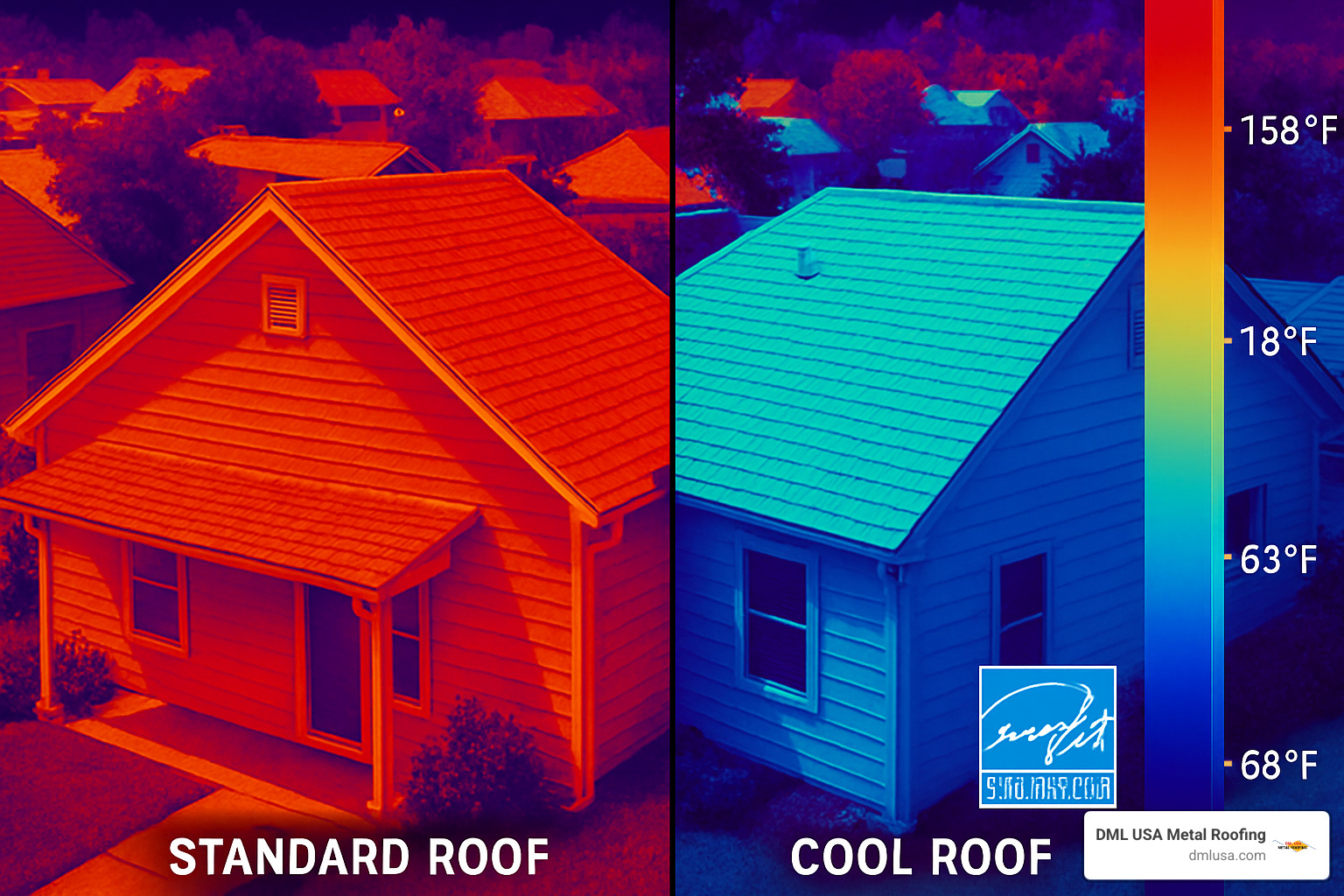

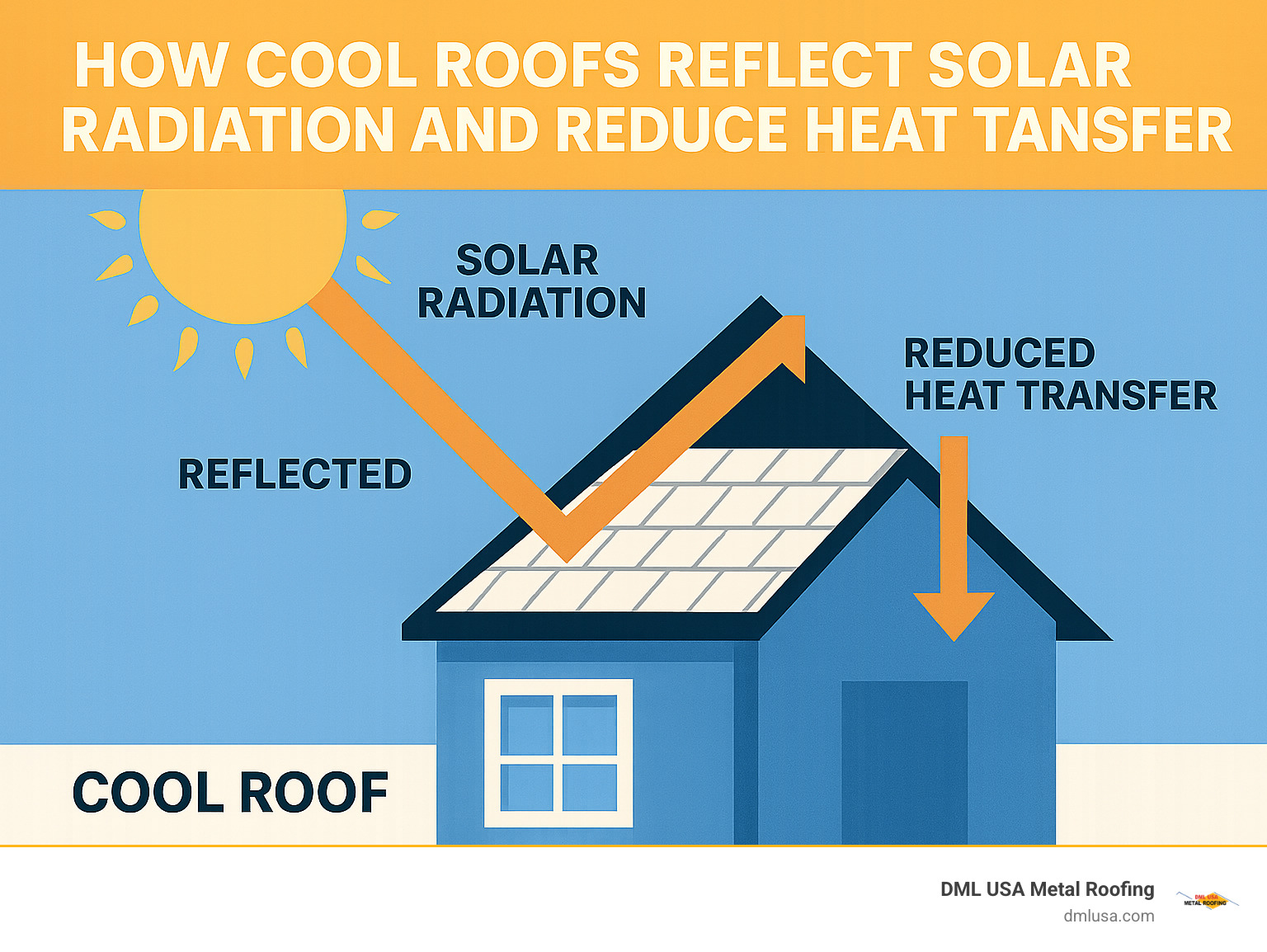

Upgrading to an energy-efficient roof is more than just a smart home improvement—it’s a way to save money while reducing your environmental impact. Energy Star certified roofing materials reflect more of the sun’s rays, which can lower roof surface temperature by up to 100°F and reduce cooling costs by 7-15% annually.

If you’re a homeowner frustrated with high energy bills or frequent roof repairs, energy-efficient roofing materials offer a durable, long-lasting solution that can improve your home’s value while providing significant tax savings.

I’m Adam Kadziola from DML USA Metal Roofing, where we’ve helped hundreds of Illinois homeowners maximize their energy star shingles tax credit benefits while providing high-quality, energy-efficient metal roofing solutions. As a manufacturer with experience in the roofing industry since 2007, I’ve guided countless customers through the process of selecting qualifying materials and documenting their purchases correctly to claim these valuable tax incentives.

Quick energy star shingles tax credit terms:

– metal roof tax credit

– solar roof tax credit 2025

– solar tax credit roof replacement

Understanding the Energy Star Shingles Tax Credit

When you’re looking to upgrade your roof, the energy star shingles tax credit can be a game-changer for your wallet. This federal incentive isn’t just a nice bonus—it’s a purposeful push to help homeowners like you make smart, energy-efficient choices for your home.

Officially, this benefit is known as the Energy Efficient Home Improvement Credit (Section 25C of the Internal Revenue Code). Thanks to the Inflation Reduction Act of 2022, this credit got a major boost that makes energy-efficient roofing more affordable than ever before.

What makes this credit special is how directly it helps your bottom line. Unlike tax deductions that just reduce your taxable income, the energy star shingles tax credit cuts your tax bill dollar-for-dollar. Imagine you owe $5,000 in federal taxes and qualify for a $1,000 tax credit—your bill immediately drops to $4,000. That’s real money staying in your pocket!

As the Department of Energy points out, “This initiative incentivizes homeowners to invest in energy-efficient improvements, which is a win-win for both the homeowner and the environment.”

One thing to keep in mind: this credit is non-refundable. This means it can reduce your tax bill to zero, but won’t generate a refund beyond that point. Still, for Illinois homeowners making significant roofing upgrades, the savings can be substantial.

How the “energy star shingles tax credit” Works

The current version of the energy star shingles tax credit is more generous than ever, offering 30% of the cost of qualified energy-efficient roofing materials. This is a huge jump from the previous 10% rate that was available before 2023.

Your new roof falls under what tax experts call the “building envelope” category of home improvements, which has a yearly cap of $1,200. So even if you spend $5,000 on qualifying materials, the maximum credit you can claim for envelope improvements in a single tax year is $1,200.

Here’s an important detail many people miss: only the materials qualify—not the installation costs. For example, if you invest in $5,000 worth of energy-efficient metal roofing materials and pay $3,000 for installation, only that $5,000 in materials counts toward your credit calculation.

History of the Energy Star Shingles Tax Credit

The energy star shingles tax credit has come a long way since it first appeared:

- 2005-2007: Born through the Energy Policy Act of 2005, the credit started modestly at 10% of cost up to a $500 maximum.

- 2009-2010: During the economic recovery period, the American Recovery and Reinvestment Act temporarily boosted the credit to 30% of cost up to $1,500.

- 2011-2022: The credit scaled back to 10% of cost with a $500 lifetime limit, though Congress extended it several times.

- 2023-2032: The game-changing Inflation Reduction Act expanded the credit to 30% of cost up to $1,200 annually with no lifetime limit.

This evolution is a huge improvement for homeowners. Under the old rules, once you claimed $500 in total credits—ever—you couldn’t claim any more, even years later. Now, the credit refreshes each year through 2032, meaning you can claim up to $1,200 annually for building envelope improvements like your energy-efficient roof.

For Illinois homeowners considering metal roofing, this extended timeframe and higher credit amount makes energy-efficient upgrades much more accessible and affordable than ever before.

Eligibility: Roofing Materials & Homeowner Requirements

Not all roofing materials qualify for the energy star shingles tax credit. To be eligible, materials must meet specific Energy Star requirements and be properly certified.

Qualifying Roofing Materials:

When it comes to roofing materials that qualify for the tax credit, you have two main options. First, metal roofs with pigmented coatings that reflect sunlight and heat away from your home. Here at DML USA Metal Roofing, we’re proud that our metal roofing products featuring Kynar 500 (PVDF) and siliconized polyester coatings meet these requirements beautifully.

Your second option is asphalt roofs with cooling granules. These aren’t your standard asphalt shingles – they’re specially designed with reflective granules that bounce sunlight away rather than absorbing heat, helping keep your home cooler during those sweltering summer months.

Both types of roofing must meet Energy Star’s strict standards for solar reflectance and thermal emittance. Don’t worry about figuring this out on your own – a qualifying roof will come with a Manufacturer’s Certification Statement that clearly states the product meets these requirements. You can also verify products through the Energy Star Certified Product Directory lookup.

I recently spoke with Lisa Johnson, who installed our Energy Star certified metal roof on her Naperville home. She told me, “I was initially overwhelmed by all the tax credit requirements, but having that Manufacturer’s Certification Statement made claiming my credit so straightforward. Plus, my new roof looks fantastic!”

Homeowner Eligibility Requirements:

The energy star shingles tax credit isn’t just about having the right materials – you need to meet certain criteria as a homeowner too.

First and foremost, the roof must be installed on your existing principal residence – that’s the place you call home most of the year. Your home needs to be located in the United States, and unfortunately, new construction doesn’t qualify for this particular credit.

If you’re thinking about claiming the credit for your vacation cabin or beach house, there’s good news – second homes may qualify if you use them as a residence rather than primarily as a rental property. However, rental properties themselves don’t qualify for this tax credit.

For those of you with a home office or other business use of your residence, the IRS allows the full credit if your business use is 20% or less of the home. If your business use exceeds that threshold, you’ll need to allocate the credit proportionally.

One of our customers, Michael from Springfield, shared: “I work from home three days a week in my dedicated office, but since that’s less than 20% of my home’s square footage, I was able to claim the full credit on my metal roof installation. The energy savings plus the tax credit made upgrading to a metal roof a no-brainer.”

Having the right documentation is key. Keep your receipts and that all-important Manufacturer’s Certification Statement safe with your tax records to support your claim should the IRS have any questions.

How Much Can You Save? Caps, Limits & Stacking Strategies

When homeowners ask me about the energy star shingles tax credit, I always see their eyes light up at the potential savings. This credit is genuinely valuable, but understanding how the limits work helps set realistic expectations.

Basic Calculation and Limits

Here’s the good news: the government is offering to pay for nearly a third of your qualifying roof materials. The credit equals 30% of what you spend on those energy-efficient roofing materials. However, there are some caps to be aware of:

- The annual building envelope cap is $1,200 (this category includes your roof, windows, doors, and insulation)

- The total annual energy efficiency credit cap is $3,200 (this includes all qualifying home improvements)

Let me break this down with some real-world examples I’ve seen with our customers:

Sarah from Springfield spent $5,000 on our energy-efficient metal roofing materials. Her initial calculation showed a potential credit of $1,500 (30% of $5,000). However, because of the $1,200 annual cap on building envelope improvements, her actual credit was limited to $1,200. She was still thrilled with the savings!

Meanwhile, Michael in Chicago invested $3,000 in qualifying roofing materials. His credit came to $900 (30% of $3,000), which fell below the cap and was fully allowable on his tax return.

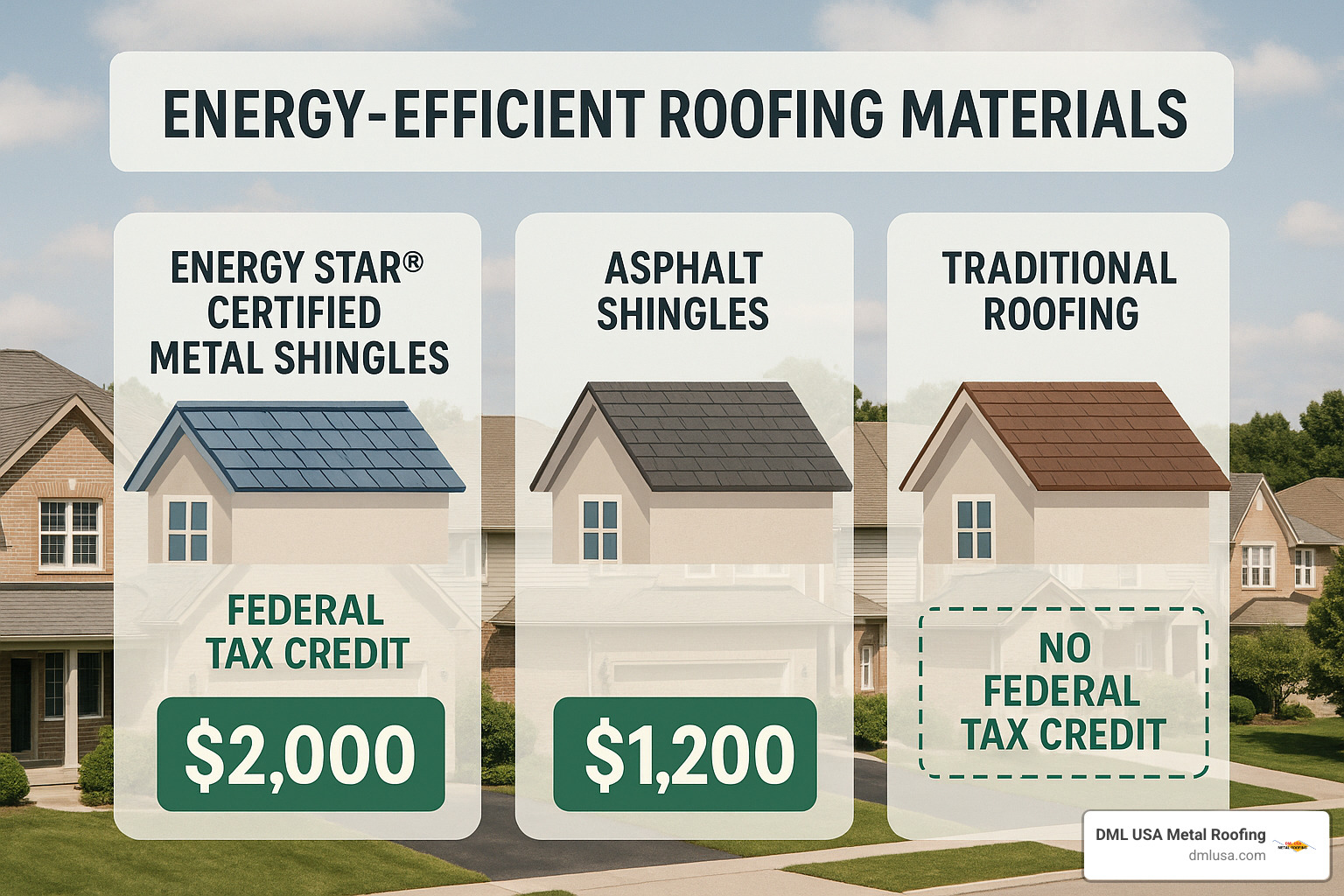

Comparing Pre-2023 vs. Current Credit Values

The recent changes to the energy star shingles tax credit have made it much more valuable than before:

| Aspect | Pre-2023 Credit | 2023-2032 Credit |

|---|---|---|

| Credit Rate | 10% | 30% |

| Maximum Credit | $500 (lifetime) | $1,200 (annual) |

| Eligible Materials | Energy Star metal & asphalt | Energy Star metal & asphalt |

| Installation Costs | Not included | Not included |

| Claim Frequency | Once (lifetime limit) | Annually through 2032 |

The difference is night and day. Before 2023, once you claimed $500 total, you were done for life. Now, you can claim up to $1,200 every year through 2032. That’s potentially $12,000 in tax credits over the decade if you make qualifying improvements each year!

Strategic Credit Stacking

Here’s where planning can really pay off. Many of our savvy customers have found ways to maximize their benefits through strategic timing and combining incentives:

You can combine your energy star shingles tax credit with solar credits in the same year. If you’re installing solar panels, you can claim both the 25C roofing credit and the 25D Residential Clean Energy Credit (which is 30% for solar with no upper limit).

Consider spreading improvements across tax years. One of our customers, Jennifer, told me: “I installed my metal roof in December 2023 and waited until January 2024 for my heat pump installation. This allowed me to claim the maximum credit in both tax years instead of hitting the cap in a single year.”

Be mindful of rebates. If you receive utility or manufacturer rebates, these generally reduce your eligible cost basis for the tax credit calculation. For example, if you spend $4,000 on qualifying materials but receive a $500 utility rebate, your credit would be based on $3,500.

The latest research from Clean Energy confirms that combining these incentives is one of the smartest ways to maximize your overall savings while improving your home’s energy efficiency.

I’ve seen the relief on homeowners’ faces when they realize these credits are now available year after year, not just once in a lifetime. It’s made energy-efficient roofing a much easier decision for many Illinois families we work with.

How to Claim Your Energy Star Shingles Tax Credit

Ready to get that sweet tax break for your new energy-efficient roof? Claiming your energy star shingles tax credit isn’t complicated, but it does require some organization and attention to detail. Let’s walk through the process together.

Required Documentation

Think of tax credit documentation as telling the story of your roof upgrade. You’ll need three key pieces to complete this story:

First, hang on to those detailed receipts and invoices. The IRS wants to see exactly what you paid for materials separate from installation costs, since only the materials qualify. I always recommend asking your contractor to itemize these costs clearly on your invoice.

Second, you’ll need a Manufacturer’s Certification Statement. This is simply the manufacturer’s formal declaration that their product meets Energy Star requirements. At DML USA Metal Roofing, we provide this certification automatically with all our qualifying products, so you don’t have to chase it down.

Finally, save any Energy Star labels or product documentation that came with your roofing materials. These provide additional proof that your purchase qualifies for the credit.

Filing Process

When tax season arrives, you’ll need to tackle IRS Form 5695, “Residential Energy Credits.” Don’t worry – it’s not as intimidating as it sounds!

Head straight to Part II of Form 5695, which covers the Energy Efficient Home Improvement Credit. You’ll enter the cost of your qualified roofing materials (remember, materials only!), calculate 30% of that amount, and apply the appropriate cap ($1,200 for envelope improvements). Then simply transfer that credit amount to your Form 1040.

Be sure to file by the tax deadline, typically April 15th of the year following your installation. And keep all your documentation for at least three years after filing – the IRS has been known to ask questions!

One of our customers, Sarah Johnson from Northlake, IL, shared her experience: “The first time I claimed the credit, I was worried about making a mistake. But with the proper documentation from DML USA and following the form instructions carefully, it was much simpler than I expected.”

The “in-service date” determines which tax year you claim the credit. If your beautiful new roof was installed in December 2023, you would claim it on your 2023 tax return filed in 2024.

If you’re feeling uncertain about the process, the IRS Form 5695 Instructions provide detailed guidance. You might also consider consulting with a tax professional who can ensure you’re maximizing all available credits.

For those interested in the science behind efficient roofing systems, the Department of Energy offers fascinating research on efficient roofs that explains why these improvements make such a difference in your home’s energy performance.

Beyond the Numbers: Added Benefits, State Incentives & Pro Tips

While the energy star shingles tax credit puts money back in your pocket at tax time, the advantages of upgrading to an energy-efficient roof extend far beyond that April 15th deadline.

Energy and Environmental Benefits

Your roof takes the brunt of summer heat, and standard roofing materials can reach scorching temperatures of 150-185°F on hot days. Energy Star certified materials dramatically change this equation by reflecting more sunlight away from your home.

“The difference is remarkable,” explains homeowner Mike Peterson from Aurora. “After installing our reflective metal roof, the upstairs bedrooms that used to be unbearably hot in summer are now comfortable without cranking the AC.”

These cool roofing materials can lower surface temperatures by up to 100°F compared to standard materials. This translates directly to energy savings, reducing your cooling costs by 7-15% annually. For many Illinois homeowners facing hot, humid summers, this means more comfortable indoor temperatures and less strain on air conditioning systems.

Beyond your personal comfort, these roofs contribute to environmental benefits by reducing peak cooling demand by 10-15%, which helps utility companies avoid firing up additional power plants during heat waves. They also last longer because they experience less thermal expansion and contraction that causes materials to break down over time.

Additional Financial Incentives

The federal energy star shingles tax credit is just the beginning of potential savings. Smart homeowners can layer multiple incentives to maximize their return on investment.

Many Illinois utility companies offer rebates for energy-efficient home improvements, including roofing. ComEd and Ameren Illinois periodically run programs that can provide additional cash back when you upgrade.

Don’t overlook state and local incentives either. The Database of State Incentives for Renewables & Efficiency (DSIRE) maintains an updated list of Illinois-specific programs that you might qualify for. These programs change frequently, so it’s worth checking before making your purchase.

“I was pleasantly surprised to find my insurance company offered a 5% discount on my homeowner’s policy after installing our impact-resistant metal roof,” shares Lisa Tompkins from Naperville. Many insurance providers recognize that quality roofing materials reduce claim risks, especially in areas prone to severe weather.

When it’s time to sell, these improvements typically increase your home’s resale value too. Energy-efficient features are increasingly important to today’s home buyers, who understand the long-term value of lower utility bills.

Pro Tips for Maximizing Benefits

Before jumping into a roof replacement, consider starting with a professional energy audit. This relatively inexpensive assessment can identify the most cost-effective energy improvements for your specific home. As our customer James Wilson finded, “My energy audit revealed that upgrading my attic insulation first would maximize the benefits of my new metal roof.”

Plan your improvements strategically across multiple tax years. If you’re considering several energy upgrades, spreading them out can help you avoid bumping against annual credit caps. For instance, doing your roof in December and your heat pump in January lets you claim the maximum credit in two different tax years.

Think about the long-term value when comparing roofing options. While the upfront cost of energy-efficient metal roofing is higher than traditional asphalt, metal roofs typically last 40-70 years compared to just 15-30 years for asphalt shingles. Factor this longevity into your cost-benefit analysis, along with reduced maintenance costs.

Consider pairing your roof with solar panels if you’re interested in maximizing energy independence. “Metal roofing and solar panels have complementary lifespans,” notes renewable energy researcher Dr. Emily Chen, “with PV systems lasting about 32 years and metal roofs up to 60 years.” This means you won’t need to remove and reinstall your solar system for a roof replacement halfway through its life.

At DML USA Metal Roofing, we’ve helped hundreds of Illinois homeowners steer these options and find the perfect balance between upfront costs and long-term benefits. Our energy-efficient metal roofing systems not only qualify for the energy star shingles tax credit but also provide decades of protection and performance for your home.

Frequently Asked Questions about the Energy Star Shingles Tax Credit

Do installation costs qualify?

One of the most common questions we hear from homeowners is about installation costs. Unfortunately, the energy star shingles tax credit only applies to the materials themselves – not the labor to install them.

Think of it this way: if your total roofing project costs $10,000, and your itemized invoice shows $6,000 for materials and $4,000 for labor, you can only calculate your 30% credit based on that $6,000 figure.

“I nearly made this mistake on my taxes,” admits Frank, a homeowner from Naperville who worked with us last year. “Thankfully, my contractor provided a clearly itemized invoice that separated materials from labor, which made filing correctly much easier.”

This materials-only rule is consistent across the entire Section 25C program, so keep this in mind when budgeting for your project and estimating your potential tax savings.

Can I combine the credit with solar incentives?

Absolutely! This is where things get really exciting for homeowners looking to maximize their energy efficiency and tax savings. You can definitely claim both the energy star shingles tax credit (Section 25C) and the Residential Clean Energy Credit (Section 25D) for solar panels in the same tax year.

The solar credit is particularly generous – offering 30% of the total cost with no upper dollar limit through 2032. Even better, unlike the roofing credit, the solar credit includes both materials AND installation costs.

Maria from Oak Park told us: “I installed both a metal roof and solar panels last year. The combined tax credits covered nearly a third of my total project cost, making the upgrade much more affordable than I initially thought. My metal roof from DML USA was the perfect foundation for the solar panels.”

When you pair these two improvements, you’re essentially creating a complete energy-efficient roofing system that both reflects unwanted heat and generates clean electricity.

Does new construction qualify?

Here’s where we need to be crystal clear – new construction does not qualify for the energy star shingles tax credit. This credit is specifically designed as an incentive for improving existing homes, not for new builds.

Even if your brand-new home uses the most energy-efficient roofing materials available, you won’t be able to claim this particular tax credit. However, if you’re replacing the roof on your existing primary residence – whether it’s 5 years old or 50 years old – you can claim the credit as long as you use qualifying materials.

“I was disappointed to learn I couldn’t claim the credit on my new construction,” shares Tom from Chicago, “but I’m keeping it in mind for when I eventually need to replace the roof. The tax savings will definitely influence my choice of materials down the road.”

While new construction doesn’t qualify for this specific credit, there may be other incentives available for energy-efficient new homes through different programs. It’s always worth checking with your tax professional about all available options.

Conclusion

The energy star shingles tax credit is truly a game-changer for homeowners looking to make their houses more energy-efficient while keeping some hard-earned money in their pockets. With the generous 30% credit rate and annual reset through 2032, this is the perfect time to consider upgrading your roof to materials that work harder for you and our planet.

Here at DML USA Metal Roofing, we take pride in our Illinois-manufactured, high-quality metal roofing products. Our solutions don’t just qualify for federal tax credits – they’re built to last decades longer than traditional materials. When those summer storms roll through or winter winds howl, our metal roofing stands strong with exceptional durability and resistance to fire, wind, and impact damage.

As you consider your options, remember these simple truths about the energy star shingles tax credit:

You can claim 30% of your material costs each year, up to $1,200 annually through 2032. That’s money directly back in your pocket, year after year. Just make sure you’re investing in properly certified Energy Star materials and keeping all your paperwork organized. When tax time comes, IRS Form 5695 will be your friend – it’s straightforward once you know what you’re doing.

Many of our customers have found success by timing their home improvements strategically. Sarah from Naperville told us, “I spread my energy upgrades across two tax years instead of doing everything at once. This let me maximize my credits without hitting those annual caps.”

The real beauty of energy-efficient roofing goes beyond tax savings. Your home becomes more comfortable, your energy bills shrink, and you’re doing something positive for the environment. It’s what we call a triple win.

Ready to explore how our metal roofing can transform your home while maximizing your tax benefits? Learn more about our products or reach out today. We’re real people who understand Illinois homes and Illinois weather, and we’re here to help you make the smartest choice for your specific situation.

After all, your roof protects everything that matters most. Shouldn’t it also help you save money while doing its job?