new roof with solar panels tax credit: 5 Powerful Savings Tips 2025

Understanding the Solar Tax Credit for Roof Replacement

Can a new roof qualify for the solar tax credit?

- No, traditional roofing materials and labor DO NOT qualify for the federal solar tax credit

- Exception: Solar roof tiles/shingles that generate electricity DO qualify

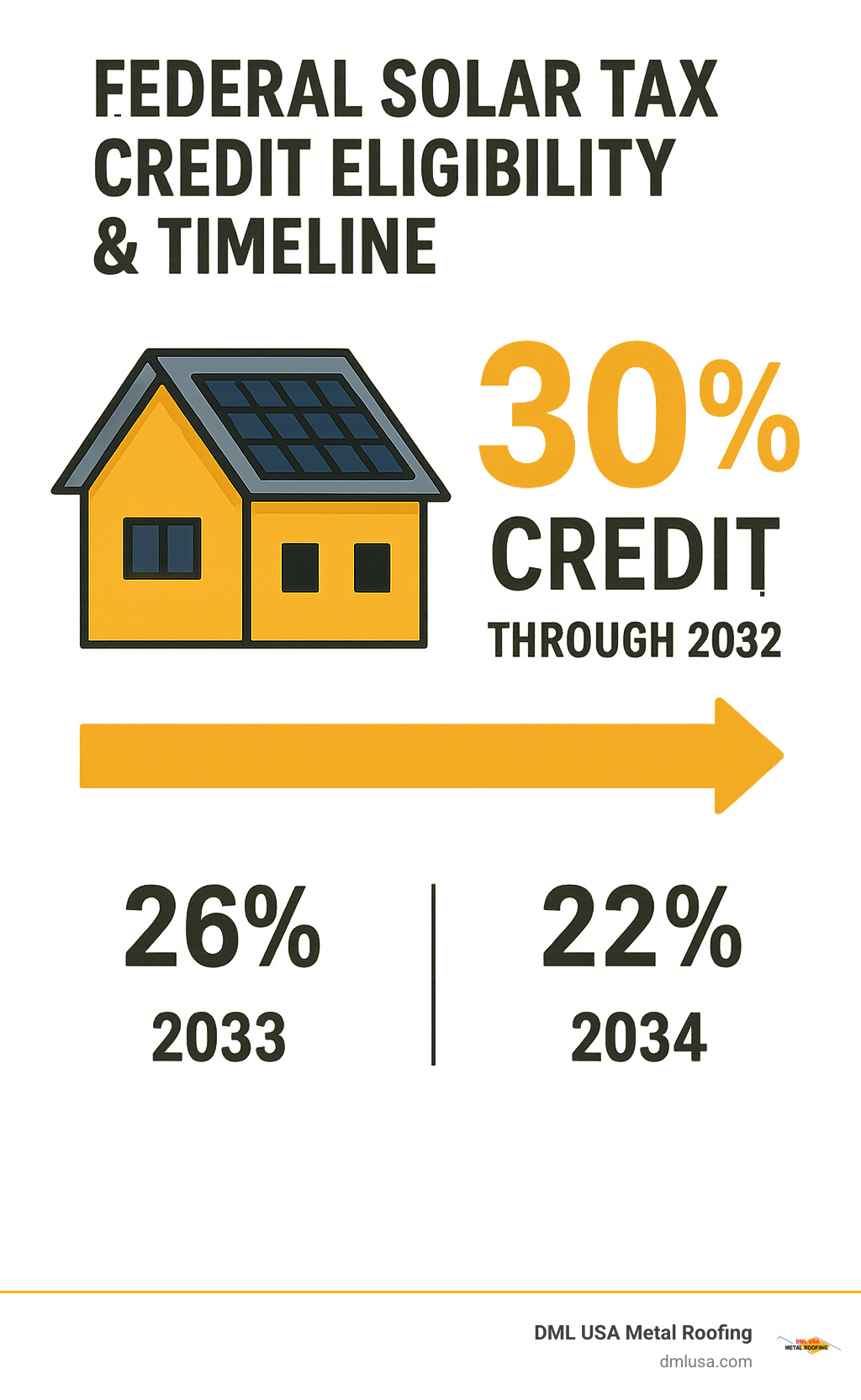

- Current credit: 30% of eligible solar costs through 2032

- Required: Separate invoices for roofing work and solar installation

If you’re considering installing a new roof with solar panels tax credit benefits are important to understand before making any decisions. The federal Residential Clean Energy Credit (commonly called the solar tax credit) offers a substantial 30% credit on solar panel systems, but there’s significant confusion about whether roofing costs qualify.

The short answer: standard roof replacements are NOT eligible for the solar tax credit, even when installed at the same time as solar panels. This is explicitly stated in IRS guidance. Only solar roofing tiles or shingles that actually generate electricity qualify for the credit.

Many homeowners have been misled by aggressive solar sales tactics suggesting they can include their entire roof replacement cost in the tax credit calculation. This is incorrect and could trigger an audit.

What expenses DO qualify? The 30% credit applies to:

– Solar panels and cells

– Inverters and wiring

– Mounting equipment

– Battery storage (3+ kWh)

– Installation labor

– Permitting fees

I’m Adam Kadziola, and as a metal roofing manufacturer with extensive experience helping homeowners steer the complexities of new roof with solar panels tax credit regulations, I’ve seen how proper planning can maximize legitimate benefits while avoiding costly compliance mistakes.

New roof with solar panels tax credit terms made easy:

– metal roof tax credit

– metal roof tax credit 2025

– solar tax credit roof replacement

How the Federal Residential Clean Energy Credit Works

The Federal Residential Clean Energy Credit (formerly known as the Investment Tax Credit) is truly a game-changer for homeowners considering solar. Currently offering a generous 30% credit on your solar investment, this incentive can dramatically reduce the overall cost of going solar—with no upper limit on the amount you can claim.

What makes this credit particularly valuable is how directly it impacts your bottom line. Unlike deductions that merely reduce your taxable income, this is a dollar-for-dollar reduction of your actual tax bill. If you owe $10,000 in federal taxes and qualify for a $7,000 solar credit, you’ll only need to pay $3,000. It’s that straightforward!

Thanks to the Inflation Reduction Act of 2022, this 30% rate is locked in through 2032, giving homeowners plenty of time to plan their solar investment. After that, the rate will step down to 26% in 2033 and 22% in 2034, before potentially expiring in 2035 (unless Congress extends it again).

The IRS defines qualified solar electric property costs as “property that uses solar energy to generate electricity for use in your home.” This encompasses not just the panels themselves, but the entire system needed to generate electricity.

As Mark from Naperville told us after his installation: “I was surprised by how simple the credit worked. My $25,000 solar system saved me $7,500 on my taxes. My installer was upfront that my new metal roof had to be handled separately for tax purposes, which saved me from a potential headache with the IRS.”

Credit Math 101

Understanding how the credit translates to real savings is straightforward. Simply multiply your eligible solar costs by 30%:

Total eligible solar costs × 30% = Your tax credit amount

For example, a $20,000 solar system yields a $6,000 tax credit, while a $30,000 system results in $9,000 in tax savings. This is a credit against taxes owed, not an immediate discount or rebate.

The timing hinges on when your system is “placed in service”—meaning fully installed and operational. If your system is up and running by December 31st, you can claim the credit on that year’s tax return.

What if your tax liability is less than your credit amount? No problem! The carry-forward provision allows you to roll unused credit portions to future tax years. If you have a $6,000 credit but only owe $4,000 in federal taxes, you can claim $4,000 this year and carry the remaining $2,000 to next year’s taxes.

What Expenses Count

To maximize your legitimate new roof with solar panels tax credit benefits, it’s crucial to understand exactly which expenses qualify. The IRS is quite specific about eligible costs, which include:

Solar system components: Solar panels, inverters (which convert DC power to usable AC power), mounting equipment and racking, wiring, and electrical components all qualify.

Battery storage: Systems with 3+ kWh capacity now qualify when installed with solar—a fantastic benefit for homeowners wanting energy independence.

Installation costs: Labor for preparation, assembly, and installation, along with permitting fees, inspection costs, and developer fees are all eligible.

Taxes and miscellaneous: Sales taxes on eligible expenses also count toward your credit calculation.

Sarah, a homeowner from Chicago who recently paired solar with her new DML metal roof, shared: “Having my installer provide an itemized breakdown of qualifying components made filing for the credit much easier. I felt confident I was claiming exactly what I was entitled to—no more, no less.”

For more detailed information about how solar components integrate with our metal roofing systems, visit our Resources page where we explain the perfect pairing of durable metal roofing with solar technology.

New Roof with Solar Panels Tax Credit: What Qualifies and What Doesn’t

Let’s clear up one of the biggest misconceptions I hear from homeowners every day. Despite what some aggressive solar salespeople might tell you, new roof with solar panels tax credit benefits do not extend to traditional roofing materials. This is a persistent myth that has unfortunately led many families to make financial decisions based on incorrect information.

The IRS has been crystal clear on this point: traditional roofing materials and structural components simply don’t qualify for the 30% federal solar tax credit. Your standard asphalt shingles, metal roofing panels, decking, rafters – none of these conventional materials count, even when installed simultaneously with your shiny new solar panels.

“I had three different solar companies tell me my entire roof replacement would be covered by the tax credit,” shared one Illinois homeowner we worked with last year. “Thankfully, I double-checked with my accountant before signing anything. That ‘too good to be true’ feeling was right on the money.”

The confusion often stems from solar companies that bundle roof replacement with panel installation, suggesting the entire project qualifies. This approach isn’t just misleading – it could put you at risk of an IRS audit down the road.

When it comes to roofing and solar, the IRS makes a crucial distinction between:

1. Traditional roofing materials that only serve as structural components (NOT eligible)

2. Solar roofing tiles or shingles that actively generate electricity (eligible)

This distinction isn’t just about tax compliance – it’s practical too. According to the Congressional Research Service’s study on lifespan alignment, metal roofing typically lasts 50-60 years, aligning beautifully with solar panels’ 25-30 year warranty period. Compare that to asphalt shingles, which often need replacement in just 12-20 years, potentially forcing you to temporarily remove your entire solar array mid-life.

Does the New Roof with Solar Panels Tax Credit Cover Traditional Shingles?

I wish I could tell you yes, but the honest answer is no. The new roof with solar panels tax credit simply doesn’t cover traditional roofing materials like asphalt shingles or standard metal panels – even under circumstances that might seem logical to include them.

This holds true even if you’re replacing your roof specifically to install solar, if your current roof can’t support panels without replacement, if your installer requires a new roof, if they’re financed together, or if both projects happen on the same day.

Why? The IRS views traditional roofing as primarily serving a structural function rather than an energy-generating one. The tax credit was specifically designed for components that generate, store, or distribute solar electricity.

This creates a practical challenge many homeowners don’t initially consider. With asphalt shingles lasting 12-20 years and solar panels warranted for 25-30+ years, you’ll likely face the costly proposition of removing and reinstalling your entire solar array when your roof inevitably needs replacement.

“I chose metal roofing specifically because I knew my solar panels would never outlive the roof,” one of our Illinois customers told me recently. “The long-term math made much more sense, even without including the roof in the tax credit. I’m saving thousands in the long run by avoiding that mid-life solar removal and reinstallation.”

Exceptions: Solar Shingles & Structural Upgrades Under the New Roof with Solar Panels Tax Credit

While traditional roofing materials don’t qualify, there are two important exceptions worth understanding:

1. Building-Integrated Photovoltaics (BIPV)

Solar roofing tiles, shingles, or other building-integrated photovoltaic products that serve dual functions – both as roofing material and electricity generator – DO qualify for the 30% credit. These include products like Tesla’s Solar Roof, GAF Energy’s solar shingles, and similar integrated solar roofing systems.

The IRS guidance specifically notes: “Solar panels or solar roofing tiles that serve only as a roof and also generate electricity for use in your home qualify as solar electric property.” The key requirement is that these materials must actively generate electricity – they can’t just be regular roofing materials.

2. Certain Structural Upgrades

Some structural upgrades directly related to supporting solar equipment may qualify. If your roof needs reinforcement specifically to handle the weight of solar panels, those targeted upgrades might be eligible. This could include strengthening roof trusses or adding load-bearing supports designed solely for the solar equipment.

The IRS notes: “No costs relating to a solar panel or other property installed as a roof (or portion thereof) will fail to qualify solely because the property constitutes a structural component of the structure on which it is installed.”

However, this is a narrow exception that requires careful documentation. You’ll need to clearly show that these upgrades were specifically required for your solar installation and wouldn’t have been necessary otherwise.

“When we installed a 10kW system on a customer’s new metal roof last summer,” our installation partner explained, “we carefully documented the additional structural reinforcements needed specifically for the solar array. Those targeted upgrades qualified for the credit, but the metal roofing panels themselves did not.”

The bottom line? Be skeptical of any solar company promising that your entire roof replacement qualifies for the 30% credit. Instead, consider the long-term advantage of pairing solar with our durable metal roofing that’s designed to outlast your solar system – giving you decades of worry-free renewable energy production without the headache of premature roof replacement.

Step-by-Step: Claiming Your Roof and Solar Tax Credits on IRS Form 5695

Tax season can feel like navigating a maze, especially when you’re claiming special credits like the new roof with solar panels tax credit. Let’s break down exactly what you can claim and how to do it without getting a headache or raising red flags with the IRS.

First, let’s be crystal clear about what expenses belong in which category:

| ELIGIBLE for 30% Solar Credit | NOT ELIGIBLE for 30% Solar Credit |

|---|---|

| Solar panels/modules | Traditional roofing materials |

| Inverters and power optimizers | Roof decking and underlayment |

| Mounting hardware and racking | Standard flashing and waterproofing |

| Wiring and electrical components | Gutters and drainage systems |

| Battery storage (3+ kWh) | Roof trusses and general framing |

| Solar roof tiles/shingles that generate electricity | Asphalt shingles or standard metal panels |

| Permitting and inspection fees | General roof repair or replacement |

| Labor for solar installation | Labor for roof installation |

| Monitoring systems and software | Insulation and ventilation |

When it comes time to file your taxes, you’ll need to complete IRS Form 5695 for your solar credit. Don’t worry—it’s simpler than it sounds! Here’s how to tackle it:

Start with Part I (Residential Clean Energy Credit) of the form. On Line 1, enter the total cost of your qualified solar electric property—remember, that’s just the eligible items from our table above, not your roof replacement. Continue through lines 2-5 if you have other renewable energy systems (most homeowners won’t). Add everything up on line 6, then multiply by 0.30 on line 7 to calculate your 30% credit.

Lines 8-15 help determine how much of the credit you can use this year based on your tax liability. Any leftover amount gets carried forward to next year on line 16.

As Maria from Chicago told us, “Having separate invoices for my beautiful new metal roof and my solar panel system made tax time so much easier. My accountant appreciated the clear division between what qualified for the 30% credit and what didn’t.”

The official IRS Form 5695 instructions provide detailed guidance if you get stuck on any particular line.

Documentation You’ll Need

If there’s one piece of advice I can’t stress enough, it’s this: keep everything. The IRS has a 7-year lookback period, and good documentation is your best friend if questions arise.

Here’s what you should have in your tax folder:

Your contracts and invoices should clearly separate roofing costs from solar expenses. Keep manufacturer’s certification statements for your solar equipment, along with all building permits and inspection records. Take plenty of photos before, during, and after installation—these visual records can be invaluable. Save proof of payments like canceled checks or credit card statements, utility connection agreements, and energy production reports showing your system is up and running.

Tom, a homeowner in northern Illinois, learned this lesson firsthand: “When the IRS had questions about my solar credit, I was so relieved I had kept detailed records. Because my metal roofing company and solar installer provided separate, itemized invoices, the review was resolved quickly with no adjustments.”

Want more tips on documentation? Check out our detailed articles on our Blog page.

Filing Timeline & Carry-Forward Strategy

Timing matters when claiming your new roof with solar panels tax credit. Here’s what you need to know:

Your credit eligibility begins when your system is “placed in service”—that’s the day it’s fully installed and operational, typically when it passes final inspection or gets utility approval. You’ll claim the credit for that tax year, regardless of when you made payments. So if your system goes live in December 2023, you’ll claim it on your 2023 return that you file in early 2024.

One of the best features of this credit is the carry-forward provision. If your tax bill is smaller than your credit amount, don’t worry—the unused portion carries forward to future years. There’s no expiration on how long you can carry it forward (as long as the credit itself hasn’t expired).

Some homeowners get strategic with phased installations. If you’re planning a large system but don’t have enough tax liability to use the full credit in one year, consider installing part now and expanding later. Each new addition qualifies for the credit in its completion year.

As financial advisor Sarah explained to her client: “By splitting their 12kW system into two 6kW installations over consecutive tax years, they maximized their immediate tax benefits instead of waiting years to use up a carried-forward credit.”

This approach works particularly well with our metal roofing systems, which are designed to easily accommodate future solar expansions without compromising roof integrity.

Avoiding Pitfalls: Audits, Scams, and Compliance Tips

Let’s have a heart-to-heart about something I’ve seen too often in my years in the metal roofing business: well-meaning homeowners getting caught in uncomfortable situations with the IRS because of misleading solar sales tactics. The solar tax credit is genuinely fantastic, but its value has unfortunately attracted some questionable practices.

I remember speaking with a family in Springfield who nearly made a $15,000 mistake. Their solar installer had bundled their entire roof replacement with their solar installation on a single invoice, telling them the whole amount qualified for the 30% credit. Thankfully, they sought a second opinion before filing.

The most common issues that could trigger IRS scrutiny include bundling roof replacement with solar costs on one invoice, including finance fees or loan interest in your calculations, claiming the credit for rental properties, backdating contracts to qualify for better rates, or claiming the credit before your system is actually up and running.

The consequences of incorrectly claiming your new roof with solar panels tax credit aren’t just theoretical. If audited, you could face repaying the wrongly claimed amount plus interest, additional penalties for inaccurate filing, and perhaps worst of all, increased likelihood of future audits. As one tax professional told me, “Once you’re on their radar for this, you tend to stay there.”

Common Sales Tactics to Watch For

“It sounds too good to be true because it is,” explained a homeowner from Chicago who narrowly avoided a solar scam. He was right—when someone promises you a “free roof” through tax credits, your internal alarm bells should start ringing.

Be particularly wary of door-to-door salespeople who create artificial urgency. Legitimate solar companies typically don’t use high-pressure tactics demanding same-day decisions. Take your time and get multiple quotes.

Pay close attention to how costs are presented. If your quotes or invoices don’t clearly separate roofing and solar expenses, that’s problematic. Some less scrupulous companies deliberately inflate system costs or obscure what’s what to maximize the apparent tax benefit.

I’ve even heard of companies requiring non-disclosure agreements about financing details—often because they’re hiding the fact that finance fees don’t qualify for the credit. And if a salesperson tells you “everyone claims their roof” or “the IRS doesn’t check”—run, don’t walk, in the opposite direction.

A homeowner in Peoria shared her experience: “When I questioned the salesperson about including my asphalt shingles in the tax credit, he said ‘Trust me, we do this all the time.’ When I asked for this in writing or any IRS documentation, he suddenly needed to ‘check with his manager’ and never called back.”

Staying Compliant and Sleep-Easy

I believe peace of mind is worth far more than squeezing a few extra dollars from your tax credit. Here’s how to ensure you can sleep soundly after claiming your legitimate new roof with solar panels tax credit:

First, always maintain separate contracts for your roofing work and solar installation. This creates a clear paper trail that shows you weren’t trying to bundle ineligible expenses.

Before filing, consult a qualified tax professional who understands energy credits. Yes, it costs a bit, but it’s insurance against much costlier mistakes.

Request crystal-clear, itemized invoices that make a bright-line distinction between solar and roofing costs. Your solar installer should be willing to provide this—if they resist, consider it a red flag.

Keep all your documentation for at least seven years. Store digital copies in multiple places and keep physical copies in a safe location. If the IRS comes knocking three years later, you’ll be glad you did.

Above all, maintain a healthy skepticism about deals that seem extraordinarily generous. As a Chicago-based CPA wisely noted, “Follow the rules, claim what you’re legitimately entitled to, and you’ll never have to worry about that audit notice in the mail.”

For personalized guidance on properly integrating solar with your metal roofing project, our team is always here to help. We believe in doing things right the first time—both with our roofing products and with tax compliance. Feel free to Contact our experts who can guide you through this process correctly.

Maximizing Savings Beyond the Federal Credit

Let’s face it—saving money feels good. While the 30% solar tax credit offers substantial savings, it’s just the beginning of what’s possible when you combine metal roofing with solar. I’ve helped hundreds of homeowners find additional incentives that can dramatically improve their return on investment.

Energy Efficient Home Improvement Credit (Section 25C)

Good news! The Inflation Reduction Act significantly improved the Energy Efficient Home Improvement Credit (Section 25C), creating a separate tax benefit you can claim alongside your solar credit:

- 30% credit for qualified energy efficiency improvements

- Up to $1,200 annual limit for most improvements

- ENERGY STAR certified metal roofs qualify for this credit

This means your beautiful new metal roof from DML USA can earn its own tax credit when it meets ENERGY STAR requirements for solar reflectance.

One of our Illinois customers recently shared his experience: “I was absolutely thrilled when my accountant confirmed I could claim both credits. My solar panels qualified for the 30% solar credit, and my new metal roof qualified for its own 30% credit up to the annual limit. The combined savings made the whole project much more affordable than I expected.”

Beyond federal tax credits, you might be surprised by how many additional savings opportunities exist. Many of my customers don’t realize they can stack multiple incentives, including:

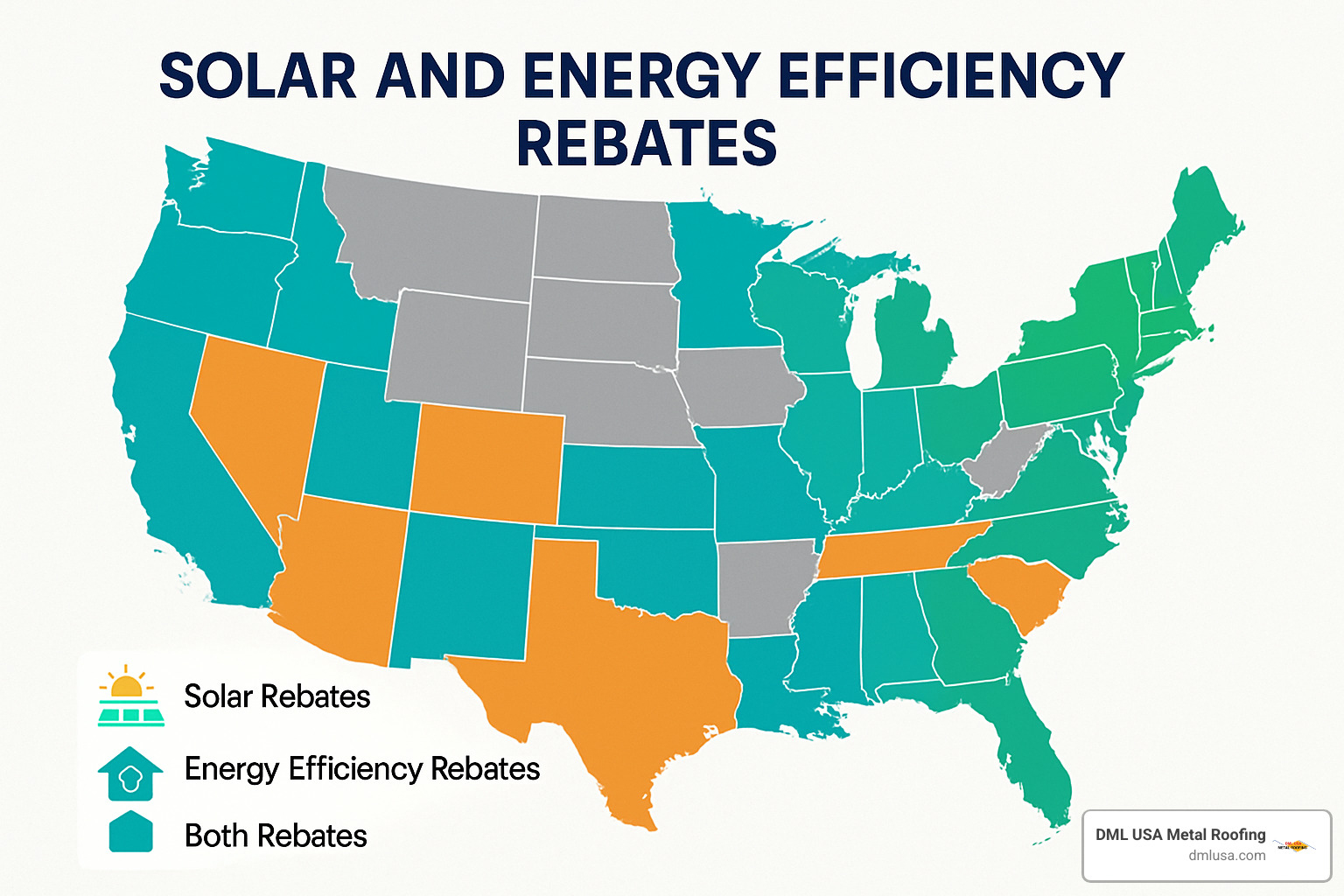

State and local rebates often provide immediate cash back on your project. Check the DSIRE database to see what’s available in Illinois.

Utility company programs like ComEd’s energy efficiency rebates can further reduce your costs.

Net metering lets you earn credits when your solar panels produce more electricity than you use—essentially making your meter run backward!

Property tax exemptions in many states mean your home’s value can increase from solar without raising your property taxes.

Solar Renewable Energy Credits (SRECs) allow you to sell certificates for the clean energy your system produces, creating ongoing income in some markets.

For more insights on why metal roofing makes both financial and practical sense, visit our Why Choose Metal Roofing page.

Pairing Metal Roofing & Solar for Long-Term ROI

When I’m helping homeowners plan their projects, I always emphasize how metal roofing and solar panels complement each other perfectly for maximum long-term value:

Matched lifespans create perfect harmony between components. Metal roofs last 50-60 years while solar panels typically last 25-30+ years. This means you won’t face the costly headache of removing and reinstalling your entire solar array for a premature roof replacement—a common problem with asphalt shingles.

Zero-penetration mounting systems attach to the standing seams of metal roofs without putting a single hole in your roof surface. This preserves your roof warranty and eliminates the most common cause of leaks in solar installations.

Recover-over-replace options are possible with metal roofing, allowing installation over existing materials in many cases. This reduces waste, saves money, and minimizes disruption to your home.

Cool-roof coatings on our metal roofing systems reflect sunlight rather than absorbing it. This not only improves your home’s energy efficiency but actually boosts solar panel performance, since cooler panels generate more electricity.

I recently visited a customer in Northlake, IL whose installation perfectly demonstrates this synergy. After installing a white metal roof with solar panels, his system consistently produces about 15% more electricity than originally estimated, thanks to the additional light reflected onto the panels from the roof surface.

Electrical Panel & Structural Upgrades

Home upgrades related to your solar installation exist in a gray area for tax credit eligibility. Here’s my straightforward advice based on years of experience with these projects:

Electrical upgrades that typically qualify include new inverters and associated wiring, electrical components specifically installed for the solar system, and monitoring systems that track solar production.

Electrical upgrades that usually don’t qualify are general electrical panel upgrades not specifically required for solar, whole-house rewiring projects, or electrical improvements you would have made regardless of solar installation.

Structural upgrades that may qualify include reinforcement specifically designed and required to support your solar panel system and the mounting hardware directly attached to the panels.

Structural upgrades that don’t qualify include general roof replacement or repairs and upgrades that would have been needed regardless of solar installation.

The best practice I recommend to all my customers: Have your contractor clearly separate and document costs directly attributable to the solar installation versus general home improvements. This transparency protects you during tax filing and potential audits.

One customer told me her accountant’s reaction when she presented her clearly itemized invoices: “This is exactly what I need to see. You’d be surprised how many people come in with vague documentation and expect me to work magic.”

By understanding and properly applying all available incentives, you’re not just saving on installation costs—you’re maximizing the lifetime value of two premium home improvements that work better together than apart.

Frequently Asked Questions about Roof & Solar Tax Credits

Can I claim the credit if I finance my solar and roof together?

Yes, but with important caveats. Financing your solar system doesn’t affect your eligibility for the tax credit, but remember – only the qualifying solar components and installation costs count, not your new roof. Those finance charges, loan interest, and extended warranties that get tacked onto your loan? Those typically don’t qualify either.

If you’re using a single loan to cover both projects, be sure to get separate, clearly itemized invoices that distinguish between your solar costs (eligible) and roofing costs (not eligible). Some financing companies love to bundle everything together, which can create headaches when tax time rolls around.

I remember talking with a homeowner from Chicago who handled this perfectly: “My lender provided one loan for the whole project, but I insisted my contractor give me separate contracts and invoices for the metal roof and solar installation. Made my life so much easier at tax time, and I didn’t have to worry about raising any red flags with the IRS.”

What happens if my roof fails before the panels are paid off?

This question really highlights why pairing solar with a quality metal roof makes so much sense. If your roof starts failing while those solar panels are still happily generating electricity, you’re looking at some painful expenses:

You’ll need to pay for removal and reinstallation of all those solar panels (typically $2,000-$5,000), risk potential damage to your solar components during the process, deal with system downtime while your roof gets replaced, and possibly even void your solar warranty if the panels aren’t professionally removed and reinstalled.

This is where DML USA’s metal roofing really shines. Our metal roofing systems last 50-60 years – about twice as long as the typical 25-year warranty on solar panels. You’ll likely never need to replace your roof during your solar system’s entire productive lifetime.

As one of our Illinois customers put it: “I did the math and realized choosing metal roofing instead of asphalt shingles meant I wouldn’t have to remove and reinstall my solar array even once. That saved me around $4,000 in future costs right there!”

Do second homes or rentals qualify for the roof and solar credits?

The rules differ depending on which credit we’re talking about.

For the 30% Residential Clean Energy Credit (the solar tax credit):

– Your primary residence absolutely qualifies

– Second homes qualify too (that lake house can go solar!)

– Rental properties, however, do NOT qualify under this specific credit (though they might be eligible for commercial solar incentives instead)

For the Energy Efficient Home Improvement Credit (which can apply to metal roofing):

– Primary residences qualify

– Second homes generally do NOT qualify

– Rental properties do NOT qualify

As a tax professional I consulted explained: “The solar credit has more flexibility – it’s available for any property you own and use as a residence, even if it’s not where you primarily live. The energy efficiency credit for metal roofing is more restrictive, generally limited to your primary home.”

If you own multiple properties and are wondering which incentives apply where, it’s definitely worth consulting with a tax professional who can evaluate your specific situation.

Conclusion

Navigating the complexities of the new roof with solar panels tax credit might seem daunting at first, but with the right information, you can make confident decisions that maximize your benefits while staying compliant with tax laws.

Throughout this guide, we’ve cleared up many misconceptions about what qualifies for the solar tax credit. Traditional roofing materials—whether asphalt shingles or metal panels—simply don’t qualify for the 30% solar credit, despite what some aggressive sales tactics might suggest. Only solar-generating materials like solar shingles or tiles make the cut for this particular incentive.

Metal roofing truly shines as the perfect partner for solar panel systems. With a remarkable 50-60 year lifespan, our metal roofs will likely outlast multiple generations of solar panels, sparing you the considerable expense of removing and reinstalling your solar array for a roof replacement. This alignment of lifespans creates significant long-term value that many homeowners overlook when initially calculating costs.

Tax compliance doesn’t need to be stressful. The simple practice of maintaining separate contracts and invoices for your roofing and solar work creates a clear paper trail that satisfies IRS requirements. This small step can save you considerable headaches down the road if questions ever arise about your credit claims.

Don’t forget to explore additional savings opportunities! Beyond the solar credit, your metal roof might qualify for the Energy Efficient Home Improvement Credit if it meets ENERGY STAR requirements. Many homeowners are pleasantly surprised to find they can claim both credits in the same tax year when properly documented.

Speaking of documentation—keep everything. Store your contracts, invoices, certification statements, permits, and photos in a safe place for at least seven years. These records are your protection and proof should the IRS ever have questions about your credit claims.

At DML USA Metal Roofing, we’ve guided countless Illinois homeowners through successful solar and metal roof installations. Our customers consistently tell us how the combination of durability, energy efficiency, and aesthetic appeal makes metal roofing their preferred choice for solar integration.

Our metal roofing systems do more than just support your solar panels—they improve your home’s value, reduce energy costs through reflective coatings, and provide superior protection against whatever weather Illinois throws your way. And with our standing seam options, your solar mounting system won’t even need to penetrate the roof surface, preserving both your warranty and your peace of mind.

Ready to discuss how our metal roofing can create the perfect foundation for your solar investment? Check out our Products page or reach out to our team today. We serve homeowners throughout Illinois, including Chicago and Northlake, and we’re committed to helping you build a sustainable, energy-efficient home that stands the test of time.