The Truth About Solar Tax Credits and Roof Replacement

Solar tax credit roof replacement eligibility is often misunderstood by homeowners. Here’s what you need to know at a glance:

| Expense Type | Eligible for 30% Tax Credit? |

|---|---|

| Standard roof replacement | NO |

| Traditional roofing materials | NO |

| Structural components (rafters, decking) | NO |

| Solar shingles/tiles that generate electricity | YES |

| Incremental cost of specialized solar-ready roofing | MAYBE (consult tax professional) |

The federal solar tax credit (also called the Investment Tax Credit or ITC) offers homeowners a substantial 30% tax credit on qualified solar electric property costs. But contrary to what some contractors might tell you, standard roof replacement costs do not qualify for this credit.

Many homeowners ask if they can include a new roof in their solar tax credit when installing panels. The IRS is clear on this: traditional roofing materials and structural components don’t qualify, even if you need a new roof to support solar panels.

The exception? Solar roofing tiles and shingles that actually generate electricity while functioning as a roof can qualify, since they serve dual purposes.

I’m Adam Kadziola from DML USA Metal Roofing, where I’ve helped countless Illinois homeowners steer solar tax credit roof replacement questions while providing durable metal roofing solutions specifically designed to withstand decades of solar panel installations. With our expertise in metal roofing that outlasts traditional materials, we ensure your investment in both solar and roofing works harmoniously for maximum financial benefit.

Solar tax credit roof replacement terms to know:

– metal roof tax credit

– metal roof tax credit 2025

Solar Tax Credit Roof Replacement: What Qualifies and What Doesn’t

I get it—the confusion around solar tax credit roof replacement makes perfect sense. When you’re investing thousands in solar panels, you want your roof to be ready to support them for the next 25+ years. Unfortunately, the IRS guidelines aren’t always as accommodating as we’d like them to be.

The IRS Energy Incentives FAQ states it pretty clearly: “In general, traditional roofing materials and structural components do not qualify for the credit.” This straightforward statement has led to countless disappointed homeowners—and sadly, some misleading sales pitches from contractors hoping to close deals.

So what actually qualifies for that sweet 30% federal Investment Tax Credit (ITC)? Let’s keep it simple:

Your solar panels, inverters, and mounting equipment? Yes, fully eligible.

The labor costs to install all that solar equipment? Absolutely covered.

Battery systems charged by your solar setup? Definitely included (as long as they’re at least 3 kWh).

Even the sales tax on these eligible expenses? Yep, that counts too.

But your standard roof replacement? That’s where the IRS draws the line. Even if you absolutely need a new roof before those panels can go up, traditional materials like asphalt shingles, underlayment, and decking don’t qualify for the 30% credit.

As Andrew Proctor from Inovateus Solar LLC puts it: “Metal is the best substrate for solar considering that the lifespan of both products match up perfectly.” This is why we at DML USA Metal Roofing often recommend metal roofing for solar installations—but even the perfect metal roof doesn’t change its tax credit eligibility.

When it comes time to claim your credit, you’ll document everything on IRS Form 5695 (Residential Energy Credits) when you file your federal taxes for the year your system is “placed in service”—basically when it’s up and running.

Does the solar tax credit roof replacement include structural repairs?

No, and I wish I could tell you differently. Those structural components like roof decking, rafters, and joists don’t qualify for the federal solar tax credit—even when they’re absolutely necessary for supporting your new solar array.

The IRS is crystal clear here: “Components such as a roof’s decking or rafters that serve only a roofing or structural function do not qualify for the credit.”

So if you’re replacing rotted decking or beefing up your rafters to handle the weight of new solar panels, you can’t include these costs in your tax credit calculation. These parts serve a structural purpose, not an energy-generating one.

I’ve heard from homeowners who tried arguing that “since the roof supports the panels, it should qualify.” While that logic makes sense to us humans, the IRS doesn’t see it that way. If they did, you could theoretically claim your entire house as part of the solar tax credit since ultimately, it’s all supporting those panels!

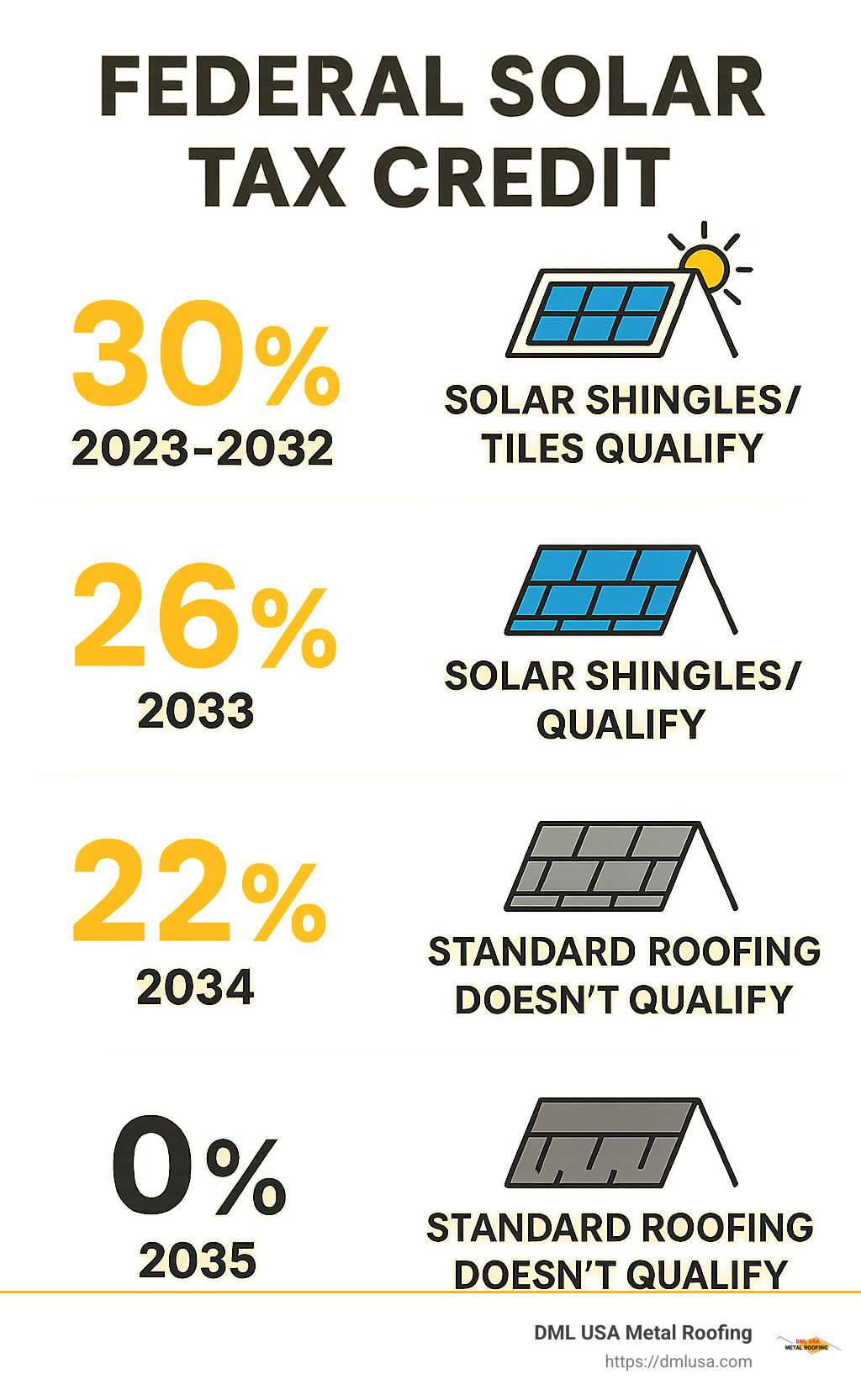

When do solar shingles make your roof eligible?

Here’s where things get interesting! The IRS does make an exception for building-integrated photovoltaics (BIPV)—things like solar shingles or solar tiles. These clever products pull double-duty by functioning as both your roofing material and solar electric collectors.

According to the IRS: “Some solar roofing tiles and solar roofing shingles serve the function of both traditional roofing and solar electric collectors, and thus serve functions of both solar electric generation and structural support. These solar roofing tiles and solar roofing shingles can qualify for the credit.”

Products like Tesla’s Solar Roof or GAF Energy’s Timberline Solar shingles fall into this special category. Instead of mounting panels on top of your roof, these integrated systems replace traditional roofing with photovoltaic shingles that generate electricity while keeping the rain out.

For commercial installations under Section 48 of the tax code, there’s an “incremental cost” concept. This means if you install a specialized reflective roof that boosts solar panel efficiency, you might claim the price difference between that roof and a standard one. For residential installations under Section 25D, though, the guidance isn’t as clear, and most tax pros recommend playing it safe.

If you’re exploring solar options for your Illinois home, we at DML USA Metal Roofing can help you understand how our durable metal roofing products work perfectly with solar installations—creating a system designed to last for decades while maximizing your Energy Incentives FAQ benefits.

Federal ITC 101: How the 30% Residential Clean Energy Credit Works

Let’s talk about the wonderful opportunity sitting on your roof! The Residential Clean Energy Credit (formerly known as the Residential Energy Efficient Property Credit) offers homeowners a substantial 30% tax break on qualifying clean energy installations. This isn’t small change – it’s real money back in your pocket.

Thanks to the Inflation Reduction Act of 2022, this credit is even more generous than before. Here’s the timeline you need to know:

- Install your system between 2022-2032: Enjoy the full 30% credit

- Wait until 2033: The credit drops to 26%

- Delay until 2034: It falls further to 22%

- Miss the boat entirely by 2035: The credit disappears completely

What does this mean in real dollars? If you invest $20,000 in a solar system, that 30% credit translates to a whopping $6,000 in federal tax savings. That’s enough to fund a nice vacation or make a significant dent in another home improvement project!

Unlike tax deductions that merely reduce your taxable income, this credit directly reduces what you owe Uncle Sam, dollar for dollar. Even better – if your tax bill is smaller than your credit amount, you can carry the remaining credit forward to future tax years. For most solar technologies, there’s no maximum limit on the credit amount (though fuel cell property does have specific limits).

To qualify for this generous credit, you’ll need to meet a few simple requirements:

1. Own your solar system outright (leased systems don’t qualify)

2. Install it on your primary or secondary U.S. residence

3. Use new equipment (no secondhand systems)

4. Have the system “placed in service” during the tax year you’re claiming

That “placed in service” date is crucial – it’s when your system is fully installed and has received any required permission to operate from your utility company. Mark this date on your calendar!

Documenting and Claiming Expenses Correctly

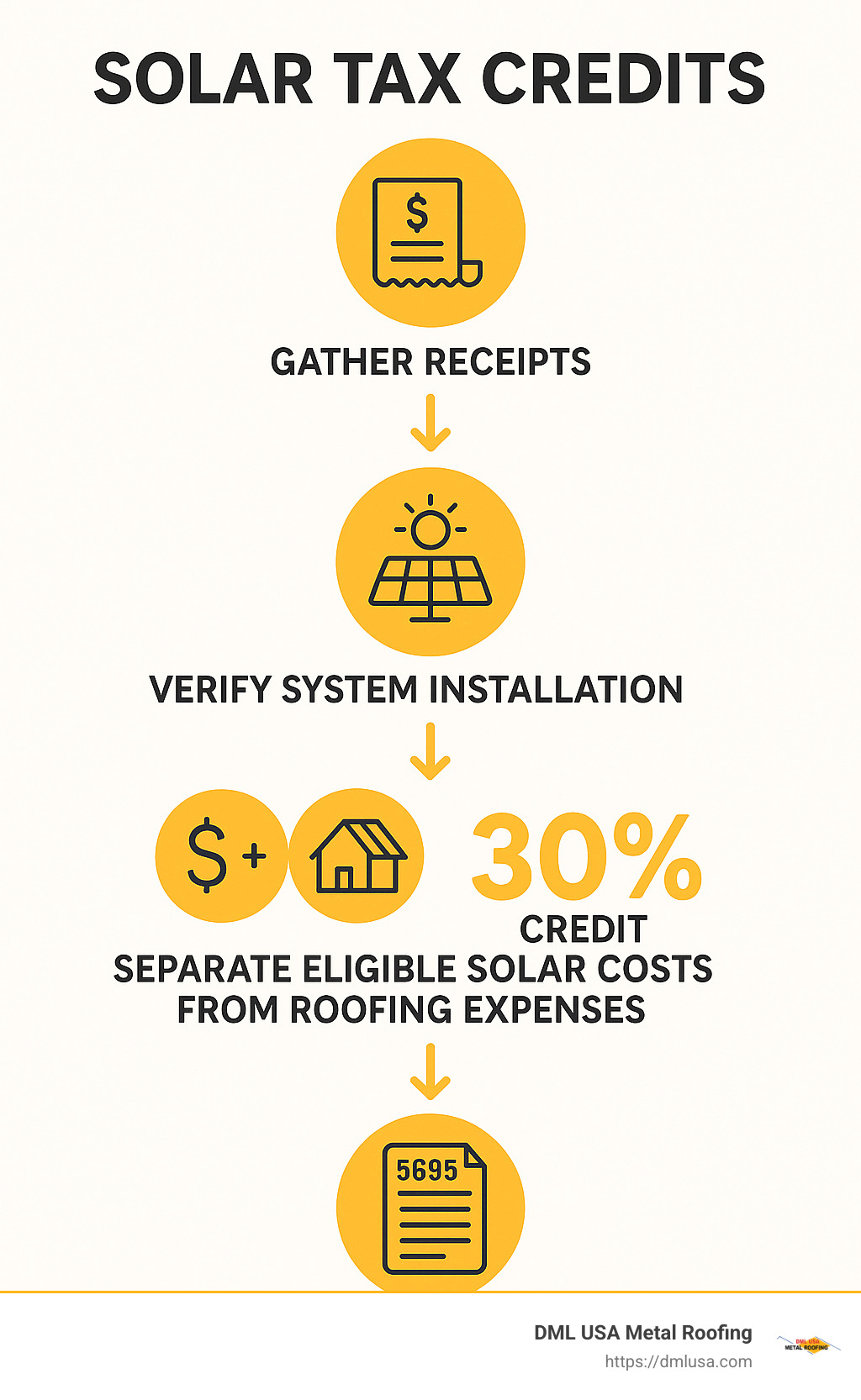

When it comes to claiming your solar tax credit roof replacement expenses, good record-keeping is your best friend. The IRS might come knocking one day, and you’ll want to be prepared.

Think of yourself as a tax detective, gathering all the evidence that proves your case. Keep every receipt, contract, certification statement, utility agreement, permit, and inspection certificate related to your solar installation. Store them somewhere safe – a dedicated folder in your filing cabinet or a clearly labeled digital folder.

Be meticulous about separating solar-specific costs from any roofing work. If you’re installing qualifying solar shingles or tiles, document their full cost. For traditional roofing materials, keep those receipts separate since they won’t qualify for the credit.

When tax time rolls around, here’s how to claim your credit:

First, grab IRS Form 5695 (Residential Energy Credits) and calculate your credit on Line 6 – that’s 30% of your qualified solar electric property costs. Next, check your Form 1040 to ensure you have sufficient tax liability to claim the credit. Then, enter your credit amount on Schedule 3 of your Form 1040. If you can’t use the full credit this year, don’t worry! You can carry the remainder forward to next year’s taxes.

Building a new home with solar included? The IRS has you covered there too. According to IRS Notice 2013-70, you can ask your homebuilder to reasonably allocate costs for the qualifying solar property, or use any other reasonable method to determine the cost.

Risks of Misclaiming Roof Costs Under the ITC

Let’s be honest – it might be tempting to include your entire roof replacement in your solar tax credit claim, especially if a contractor suggests it. But this shortcut could lead to a painful dead end.

The IRS doesn’t take kindly to improper tax credit claims, and the consequences can hit your wallet hard. If you’re audited and found to have incorrectly claimed roofing expenses, you’ll face a cascade of problems: repaying the improperly claimed credit, potential accuracy-related penalties of 20% of the underpayment, interest on both the credit amount and penalties, and possibly increased scrutiny on your future tax returns.

I’ve seen this play out in real life. A family in Salem, Oregon replaced their roof alongside a solar installation after their contractor suggested including the roof in their tax credit claim. Two years later, an IRS audit resulted in them repaying over $5,000 in improperly claimed credits, plus penalties and interest. That’s a costly lesson!

Some folks rationalize including roof costs because “everyone does it” or “the chance of audit is low.” This approach isn’t just illegal – it’s increasingly risky. The IRS has been beefing up its enforcement resources, and renewable energy credits are getting extra attention due to their growing popularity.

To stay on the right side of the tax code, work with a qualified tax professional who understands renewable energy credits. Get written confirmation from your installer about which costs qualify. Be skeptical of any contractor who insists your entire roof replacement qualifies – they won’t be the ones facing the audit! And document everything carefully, with separate invoices for roofing and solar work.

At DML USA Metal Roofing, we believe in doing things right the first time. While we’d love to tell you that your entire solar tax credit roof replacement project qualifies for tax credits, we value honesty and your long-term financial well-being too much for that kind of shortcut.

Other Roofing-Related Incentives You Should Know

While your standard roof replacement won’t qualify for the 30% solar tax credit, don’t worry—there are still plenty of ways to save money when upgrading your roof! Many homeowners don’t realize there’s actually a separate tax benefit designed specifically for energy-efficient roofing materials.

The Energy Efficient Home Improvement Credit (formerly known as the Nonbusiness Energy Property Credit under Section 25C) offers meaningful savings for homeowners who choose energy-efficient roofing materials. Starting in 2023, this credit provides 30% of the cost of qualified energy efficiency improvements, though annual limits apply—generally $1,200 with some exceptions.

What’s particularly exciting for homeowners considering metal roofing is that metal roofs with appropriate pigmented coatings that meet Energy Star requirements typically qualify for this credit. Similarly, asphalt roofs with special cooling granules meeting Energy Star requirements may also be eligible.

This means that while your roof replacement isn’t covered under the solar tax credit roof replacement program, you might still enjoy significant tax benefits by choosing the right materials. At DML USA Metal Roofing, our energy-efficient metal roofing products are specifically designed to meet these Energy Star requirements while reducing your heating and cooling costs year-round.

Our metal roofs are built to last 50+ years—perfectly matching the lifespan of solar panels—and are engineered to easily support the weight and installation requirements of solar arrays. This long-term durability means you won’t need to remove and reinstall your solar panels for a roof replacement during the life of your solar system.

Beyond federal incentives, be sure to look into additional savings opportunities closer to home. Many Illinois homeowners are surprised to find state tax credits, local government rebates, utility company incentives, and even seasonal manufacturer rebates that can significantly reduce project costs.

For a comprehensive listing of all available incentives in Illinois, check the Database of State Incentives for Renewables & Efficiency (DSIRE). This valuable resource will help you identify every program you might qualify for in your specific location.

Stacking State, Local, and Utility Rebates with the Federal Credit

The real magic happens when you “stack” multiple incentives together. Think of it as extreme couponing, but for your home improvement project!

When combining different incentives for your solar tax credit roof replacement project, there are a few important things to keep in mind. First, the IRS requires what’s called “subsidy subtraction.” This means if you receive a $1,000 utility rebate for your $20,000 solar system, you can only claim the tax credit on the remaining $19,000. It’s still a great deal, but something to be aware of when calculating your total savings.

The good news is that utility net metering credits—where you get credit for excess electricity your system produces—don’t reduce your eligible expenses for the tax credit. This means your solar system can keep paying you back through reduced utility bills without affecting your tax benefits.

Timing is another important consideration when stacking incentives. Some programs offer immediate savings at the point of sale, while others, like tax credits, are claimed annually when you file your taxes. Planning your cash flow accordingly can help avoid any financial surprises during your project.

Illinois homeowners have a particularly advantageous position when it comes to combining incentives. You can often stack the 30% federal solar ITC with Illinois Shines solar renewable energy credits (SRECs), local utility rebates, potential property tax incentives, and the federal Energy Efficient Home Improvement Credit for qualifying roof materials.

When properly combined, these stacked incentives can dramatically reduce the overall cost of your roofing and solar project. I’ve seen homeowners cut their effective costs by 50% or more through careful planning and taking advantage of every available program. That’s the difference between a good investment and a great one!

Remember to keep meticulous records of all applications, approvals, and payments for each incentive program. This documentation will be essential when claiming tax credits and could prove invaluable if questions arise later.

Planning Your Project: Roof Lifespan, Materials, and Solar Integration

When you’re thinking about adding solar panels to your home, the condition of your roof isn’t just an afterthought—it should be front and center in your planning. Those shiny new solar panels typically last 25-30 years, and the last thing you want is to install them on a roof that’s going to need replacement when your panels are just hitting their stride.

This is where metal roofing truly shines. At DML USA Metal Roofing, our products aren’t just built to last—they’re designed to outlive your solar system with an impressive lifespan of 50-60 years. That’s double the lifespan of typical solar panels! This means you can confidently install your solar array without that nagging worry about needing to remove everything for a roof replacement down the road.

Before you move forward with your solar tax credit roof replacement project, take some time to consider these important factors:

First, have a professional assess your roof’s structure. Solar panels typically add about 2-4 pounds per square foot to your roof’s load. The good news? Metal roofing’s naturally lightweight character makes it particularly well-suited for solar integration without requiring additional structural support that might be needed with heavier roofing materials.

Always get your roofing work completed before the solar installation begins. This might seem obvious, but you’d be surprised how many homeowners try to coordinate these projects simultaneously. Completing the roof first prevents the considerable expense and hassle of removing and reinstalling panels later—a mistake that can easily add thousands to your project cost.

When reviewing warranties, pay close attention to how solar installations might affect them. Many traditional roofing warranties become void the moment someone installs solar panels. Our metal roofing warranties, however, remain valid even with solar panels in place, giving you peace of mind for decades to come.

The mounting system for your solar panels matters tremendously too. Different roofing materials require different approaches to mounting. One of metal roofing’s biggest advantages is the availability of non-penetrative mounting options that maintain your roof’s integrity and waterproofing. These specialized mounting systems attach to the standing seams without puncturing your roof surface—preserving the weathertight seal that keeps your home dry.

As Andrew Proctor, Senior Project Engineer at Inovateus Solar, notes: “Solar on metal is not a new concept, but it is a growing trend. Solar installers are targeting metal roofs for the long lifespan and ease of installation.”

I recently worked with a manufacturing facility that perfectly demonstrates this wonderful synergy. They installed a substantial 500 kW solar system on their metal roof using specialized S-5! clamps that attach securely to the standing seams without a single roof penetration. This approach maintained the roof’s integrity while providing rock-solid support for their solar investment.

When you’re planning your own solar tax credit roof replacement project, thinking about these long-term considerations will save you significant headaches and expenses down the road. A quality metal roof provides the perfect foundation for your solar investment, ensuring both systems work harmoniously for decades to come.

Solar Tax Credit Roof Replacement and Metal Roofing Synergy

There’s something special that happens when you pair metal roofing with solar panels—a perfect partnership that maximizes both energy efficiency and financial benefits. While solar tax credit roof replacement rules don’t allow you to claim traditional roofing materials as part of your solar tax credit, the overall value you’ll get from combining these technologies remains incredibly compelling.

Metal roofing brings several unique advantages to your solar installation that other roofing materials simply can’t match. For starters, our metal roofing features highly reflective coatings that significantly reduce heat absorption. This keeps your attic and home cooler, which actually improves how efficiently your solar panels operate—they perform better at lower temperatures, generating more electricity from the same amount of sunshine.

The lightweight strength of metal roofing is another game-changer. Weighing significantly less than asphalt or tile while providing superior strength, metal roofing can support solar arrays without requiring additional structural reinforcement that might be needed with heavier materials.

When it comes to weather protection, nothing beats metal. Our roofs withstand extreme conditions including high winds, hailstorms, and heavy snow loads—all potential threats to your valuable solar investment. This durability means your roof and solar system will continue working together beautifully through whatever Mother Nature throws your way.

One of my customers’ favorite benefits is how maintenance-free our metal roofing remains. Unlike other materials that require regular attention, our metal roofing virtually eliminates maintenance concerns—particularly important when accessing your roof becomes more complicated with solar panels installed.

The financial benefits of this combination are substantial. You’ll enjoy energy savings from the reflective metal roof (many homeowners report up to 25% reduction in cooling costs), electricity generation from your solar system, potential tax credits for the energy-efficient metal roof, the 30% federal ITC for your solar system, and increased home value from both premium roofing and solar generation.

When thoughtfully planned, this powerful combination delivers the best long-term return on investment while minimizing future complications and maintenance headaches—truly the smartest approach to solar tax credit roof replacement projects.

What to Do If a Contractor Claims Roof Replacement Is Covered

I’ve heard too many stories from homeowners who were told by eager solar contractors that their entire roof replacement would qualify for the 30% solar tax credit. This kind of misinformation is unfortunately common as some contractors try to make the sale more attractive. If you find yourself in this situation, here’s how to protect yourself:

First, ask for specific IRS citations. Request that the contractor show you exactly where in the IRS code it states that traditional roofing materials qualify. The truth is, IRS guidance clearly states they don’t qualify—and a reputable contractor should be forthcoming about this.

Always get claims in writing. If a contractor insists the roof qualifies, ask them to put this claim in writing, including a statement that they’ll cover any costs if the IRS disallows the claim. You’ll find most contractors quickly backpedal when asked to stand behind such claims on paper.

Request separate contracts and invoices for your roofing work and solar installation. This clear separation makes it much easier to identify which costs are eligible for the tax credit and will be invaluable documentation if questions arise later.

Don’t hesitate to seek a second opinion from a tax professional who specializes in renewable energy credits. They can provide accurate guidance based on current IRS regulations and help you steer these waters safely.

If you believe a contractor is deliberately misleading consumers about solar tax credit roof replacement eligibility, consider reporting them to your state’s consumer protection agency or contractor licensing board. These misleading practices harm consumers and reputable contractors alike.

At DML USA Metal Roofing, we believe in complete transparency. We’ll never suggest claiming ineligible expenses on your tax return. Instead, we focus on providing accurate information about legitimate incentives for our energy-efficient metal roofing products and how they perfectly complement solar installations.

Regardless of what a contractor tells you, the person signing the tax return (that’s you) is ultimately responsible for its accuracy. Taking the time to verify claims about tax credits will protect you from potential headaches with the IRS down the road.

Frequently Asked Questions about Solar Tax Credit Roof Replacement

Can I carry the credit forward if it exceeds my tax liability?

Good news for homeowners who might not have enough tax liability in a single year! The federal solar tax credit is indeed non-refundable, which means it can reduce what you owe the IRS to zero, but not beyond that point.

However, don’t worry if your credit exceeds what you owe in taxes this year. Any unused portion can be carried forward to future tax years until you’ve used it completely. There’s no time limit on this carryforward provision, which makes it incredibly valuable.

Let me give you a real-world example: Say you install a solar system that qualifies for a $6,000 tax credit, but you only owe $4,000 in federal taxes this year. You can claim the $4,000 now, zeroing out your tax bill, and then carry the remaining $2,000 forward to next year’s taxes.

This flexibility is especially helpful for retirees or others with lower annual tax liabilities. Just remember to keep careful records of any unused credit amounts and make sure they’re properly tracked on your subsequent tax returns. Your tax preparer can help you manage this process.

Which roofing components are ever eligible for the 30% credit?

When it comes to solar tax credit roof replacement, the IRS is quite specific about which roofing components actually qualify. The list is shorter than many homeowners hope:

Building-integrated photovoltaics (BIPV) are the primary roofing materials that qualify. These include solar roofing tiles or shingles that pull double-duty – they function as your actual roof while also generating electricity. Products like Tesla’s Solar Roof or GAF Energy’s Timberline Solar fall into this category.

Solar mounting hardware designed specifically for attaching panels to your roof also qualifies. This includes the rails, clamps, flashings, and other components that are part of the solar mounting system – but not the roof itself.

In some limited cases, the incremental cost of specialized roofing materials designed specifically to improve solar performance might qualify. This is somewhat of a gray area, especially for residential installations. Commercial installations under Section 48 have clearer guidance allowing for the additional cost (above standard roofing) of reflective roofing that improves solar efficiency.

What definitely doesn’t qualify? Your standard roofing materials – the shingles, underlayment, decking, and rafters – even if you’re replacing them specifically to support new solar panels. The IRS has been crystal clear on this point.

How do state incentives interact with the federal ITC for roofing and solar?

Navigating the interaction between state and federal incentives can feel like solving a puzzle, but understanding how they work together helps maximize your savings on solar tax credit roof replacement projects.

Direct cash rebates and grants from your state or utility typically reduce your eligible cost basis for the federal ITC. For instance, if Illinois or your local utility gives you a $2,000 cash rebate on your $20,000 solar system, you’ll calculate your federal tax credit based on $18,000 instead.

State tax credits generally work differently – they usually don’t reduce your federal ITC basis. This means you can enjoy the full benefit of both your state tax credits and the federal 30% credit, essentially “double-dipping” in a completely legal way.

Performance incentives like Solar Renewable Energy Credits (SRECs) don’t affect your federal tax credit calculation since they’re based on how much energy your system produces rather than what it cost to install. Here in Illinois, the Illinois Shines program provides valuable upfront incentives through SRECs that won’t reduce your federal credit basis.

Property tax exemptions – which many states offer to prevent your property taxes from increasing when you add solar – don’t impact your federal ITC calculation either.

Every state’s incentive structure is unique, which is why we at DML USA Metal Roofing always recommend consulting with a tax professional who understands both federal and Illinois-specific renewable energy incentives. They can help ensure you’re maximizing every available benefit while staying compliant with tax regulations.

If you’re planning a metal roof installation that will support solar panels, we’re happy to connect you with knowledgeable professionals who understand these complex interactions and can help you make the most of all available incentives.

Conclusion

Let’s take a moment to put everything we’ve discussed about solar tax credit roof replacement into perspective. I know there’s a lot to digest here, but the main points are actually pretty straightforward once you cut through the confusion.

First and foremost, despite what you might hear from some eager contractors, standard roof replacement costs simply don’t qualify for the 30% federal Investment Tax Credit. The IRS has been crystal clear about this. Your beautiful new asphalt shingles? Not eligible. That necessary decking repair? Also not eligible.

However, there’s a bright spot if you’re considering solar roofing tiles or shingles that actually generate electricity while serving as your roof covering. These innovative products absolutely do qualify for the full 30% credit because they’re directly involved in energy production.

I’ve seen how metal roofing creates the perfect partnership with solar installations. Think about it – a premium metal roof lasts 50-60 years, perfectly matching or exceeding the lifespan of your solar system. The strength-to-weight ratio is exceptional, and those reflective properties actually help your solar panels work more efficiently by keeping temperatures lower. It’s a match made in energy-saving heaven!

Don’t forget that while your standard roof might not qualify for the solar tax credit, other incentives are available. Many of our metal roofing products qualify for the Energy Efficient Home Improvement Credit, which can put real money back in your pocket through different tax savings.

Being meticulous with your documentation is absolutely crucial. Keep your roofing costs and solar expenses clearly separated in your records. Trust me, you’ll thank yourself later if the IRS ever comes knocking with questions about your tax credit claims.

At DML USA Metal Roofing, we believe in giving you the straight facts about what’s possible. Our premium metal roofing products are specifically engineered to provide the ideal foundation for solar panels, while also qualifying for their own energy efficiency incentives. It’s about making smart choices that will protect your home and support your clean energy goals for decades.

The bottom line? While solar tax credit roof replacement doesn’t mean your entire roof qualifies for the 30% credit, the combination of quality metal roofing with solar still delivers tremendous value through energy savings, increased home value, and the various incentives available to you.

For more information about our durable, energy-efficient metal roofing products that perfectly complement solar installations, visit our products page or reach out to our team. We’ve helped countless homeowners steer both roofing and solar incentives to maximize their savings, and we’d be happy to help you too.